Role of Market Sentiment in Token Sniping: Bull vs. Bear Market Dynamics

Crypto Market Sentiment: How it affects token sniping strategies in bull and bear markets? Learn how crypto sentiment tools can help maximize sniping opportunities.

While everyone thinks about how to make your capital earn more money for you, it’s also important to know how to protect your capital from those trying to steal it.

DeFi sniper bots are automated tools that allow traders to purchase new tokens at lightning-fast speeds — before human traders can do so. In practice, DeFi sniping means getting in first on an asset whose price you expect to go up — so you can eventually exit out of it at a higher profit margin, selling to those who got in later.

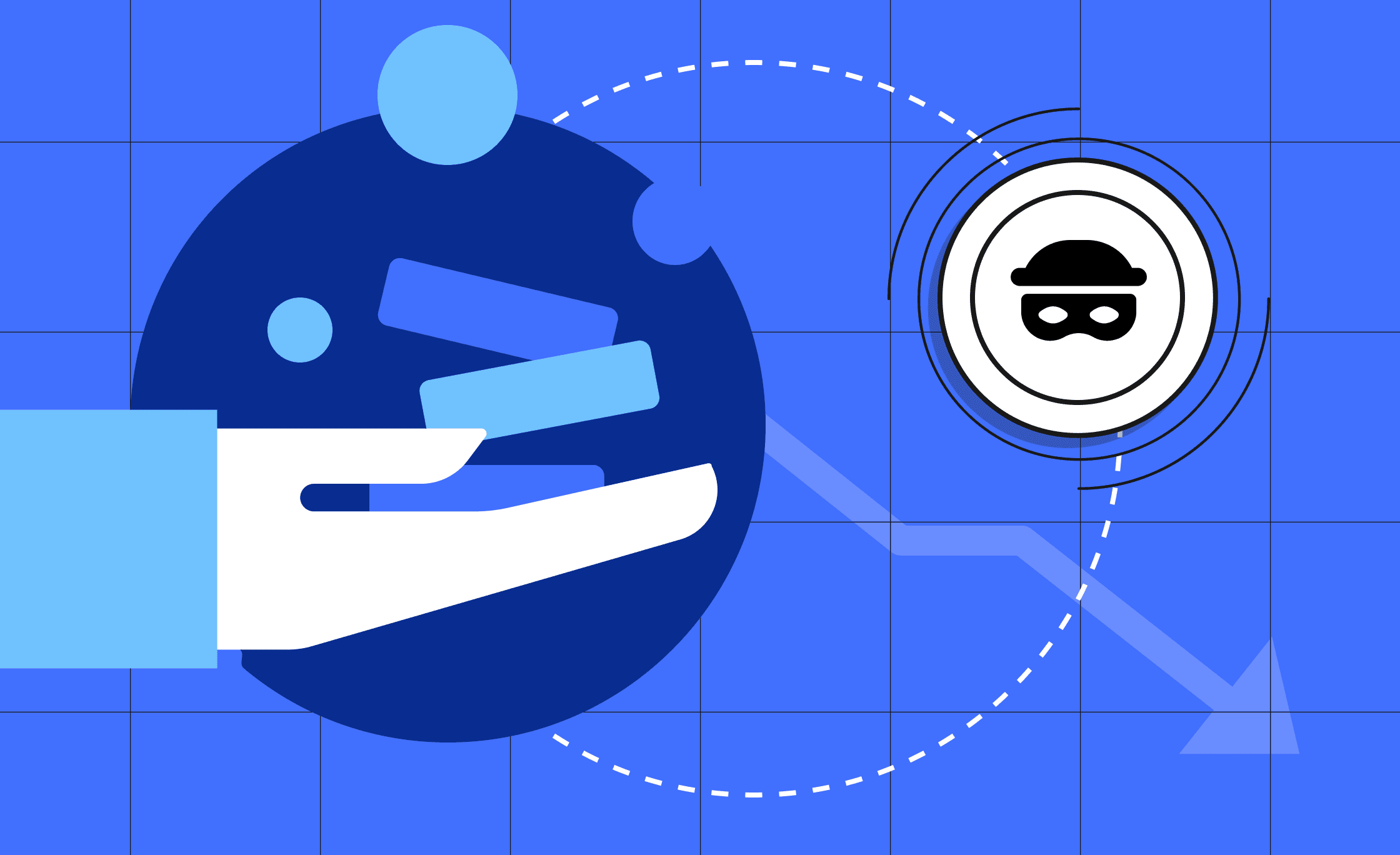

However, with the rise of DeFi hacks, rug pulls, and scams, it’s critical to use these bots safely. The scammers are smart — and getting smarter every minute. So it’s not enough to use a wallet you consider secure and invest in assets that you believe are safe. Active and comprehensive security measures are very important.

DeFi hacks have increased, with incidents costing millions of dollars worth of user funds and destroying the trust in the hacked dApps and protocols. It feels like for every smart contract and independent audit, the hackers find a vulnerability to exploit. But it’s not just the code that is getting hacked.

Scammers exploit vulnerabilities in the DeFi ecosystem, including wallet scams, phishing attacks, and rug pulls. People are often the weakest link. Scammers find all kinds of ways to trick the victims into allowing access to their sensitive information or just clicking on a link that ends up being a computer worm. And sometimes, the only thing that needed hacking was the trust of the investors into a memecoin or another token. The team may promise the world to the investor community, complete with a roadmap, tokenomics, and brilliant storytelling about everyone getting rich by buying this new token — and then pull the liquidity from the token’s trading pair in what is called a rug pull, taking the investors’ ETH or another valuable crypto and leaving them with a now-worthless shitcoin.

In December 2021, attackers used a phishing technique by inserting malicious scripts into the BadgerDAO frontend, which tricked users into signing fake transactions. The attackers siphoned off around $120 million from users who unknowingly granted permission to their wallets.

In August 2022, Curve Finance suffered a DNS hack where users were redirected to a phishing website. The attackers stole around $570,000 in funds by tricking users into signing malicious contracts on the fake site.

In October 2020, scammers launched a fake Yearn Finance website that mimicked the official one, tricking users into sending funds to malicious addresses. Several users lost their tokens by interacting with the fraudulent platform.

In March 2021, Meerkat Finance claimed it was hacked for $31 million. It was later revealed to be an insider rug pull. The project's team manipulated smart contracts and stole user funds, presenting it initially as a hack.

In October 2020, scammers used social engineering to trick users into visiting a fake Uniswap site through phishing emails or ads. Many users interacted with the fraudulent contracts, losing their tokens in the process.

But do not despair — there are security measures for protecting your capital when using sniping bots.

DeFi sniper bots are very powerful tools that should absolutely be included among your crypto trading strategies. And for the best of them, their security measures are part of the package. To use a DeFi sniping bot safely, it’s good to - at the very least - follow these basic security best practices:

Not all bots are created equal. Read the reviews on Reddit and other independent sites. Learn what security features they actually have (and how easy they are to implement). For example, the Noti sniping bot has active MEV and rug-pull protection, without requiring any technical skills to activate either.

What use are security measures if you’re not using them? Make sure whichever security features your sniping bot has are turned on. Understand what they mean. Compared to other bots, do they have safety measures that yours doesn’t?

Scammers have patterns too. For example, if $WIF is hitting it off with massive community and price growth, expect to see 20 copycats pop up within a week. Will some of them pump enough for a potential profit? Yes, likely. Will most of them go to zero before you get your money out? Probably.

Many scammers don’t even bother to appear legit. Check whether the token has a website, an active discord community (with more than 5 members messaging each other), a non-anon team with a serious reputation, etc.

As you get more used to and knowledgeable about sniping bots, you’ll know what to look for and also be more aware of scammers trying to trick you. But if you are just starting out with sniping, use caution, be alert, and don’t expose any sensitive personal information to anyone you don’t trust.

Scammers may create fake DeFi wallets or phishing sites to steal your assets. So, before connecting your sniper bot to any DeFi wallet, always verify the URL and confirm the legitimacy of the wallet. Here are some of the steps you can take to spot a scam wallet, per Datavisor:

Beyond that, use common sense: if anything looks suspicious, avoid it. And, most importantly, be very careful of phishing scams: treat any email with an attachment as a potential attack. Even if it appears to be from someone you know, hover over the “sender” part to reveal the real sending address. If you get a sudden Telegram message from a friend you haven’t heard from in years and never actually used Telegram with, it’s a scam. Be vigilant! Your data and assets are on the line.

For any sniper defi user, it’s important to understand the market. Tools like crypto sentiment charts and crypto sentiment analysis can help you assess the community’s view on a particular token or project. For example, Bitcofun has compiled a list of crypto sentiment tools by category:

These tools can help you identify suspicious tokens with unusually high or low sentiment, indicating potential scams or frauds. Use them in combination with each other and with the safety measures outlined in the previous section. At the end of the day, remember that there are plenty of sniping opportunities in legitimate projects on legitimate platforms. So there is no need to jump on the shadier “once-in-a-lifetime” opportunities.

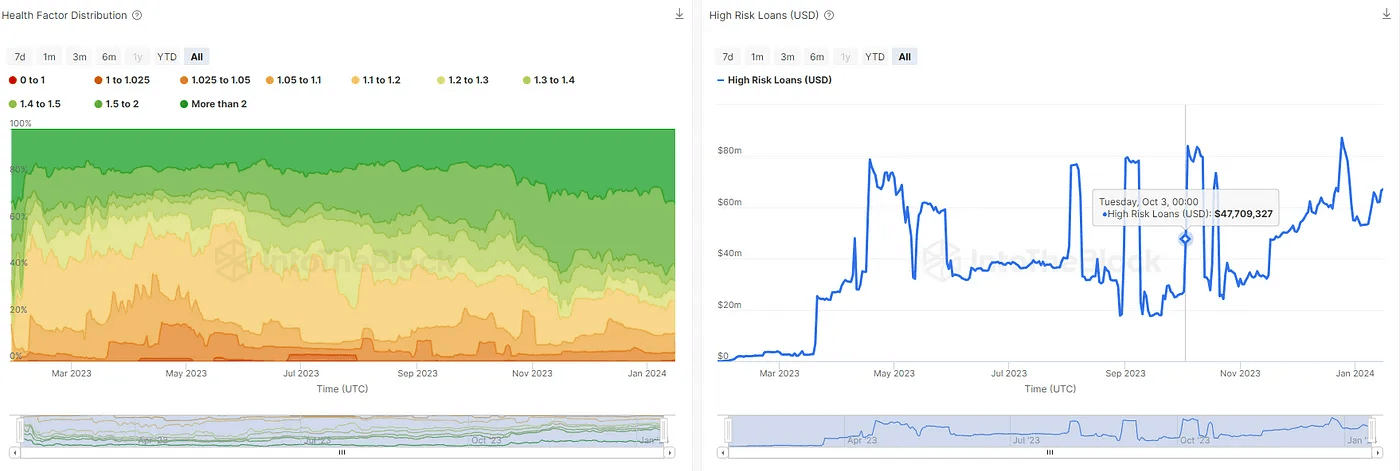

The DeFi market, while relatively young, has already grown complex and vibrant enough to have a number of tools and services available for analyzing and monitoring risk. Using at least some of them can help shape more risk-aware strategies in all types of trading, including sniping.

DeFi risk monitoring tools can help you assess the risks associated with different tokens, including defi liquidity pool risk and token vulnerabilities. Such tools include:

It’s also a good idea to stay updated with defi hacker news to learn about the latest scams and hacks that could affect your trading. It’s surprising how often the same scam or hack is repeated over and over again on unsuspecting victims.

DeFi sniper bots are token sniping platforms that allow users to buy a new token at the earliest possible moment, potentially maximizing the return and allowing for an equally swift exit.

Yes. As with any tool, it’s important to fully understand how sniping bots work and what market risks to be aware of. It’s also a good idea to start out sniping with relatively small sums of money. Since some bots are geared for technically advanced users, you may feel safer with a newer, more user-friendly sniper bot, like Noti.

With the older bots, there was a risk of the order not being executed or ending up costly because of front-run attacks. Some bots also did not offer rug pull protection from scammers. With all sniper bots, there is a risk of someone else with a faster bot getting ahead of you in the snipe both in buying and selling, hurting your profitability. Learn how to optimize your sniping in this article.

For newer liquidity sniping bots like Noti, the team is already actively protecting you via various tools in the sniping bot, including predictive AI models, monitoring for mempool activity, and more. On top of that, using the DeFi risk management tools described above and learning from previous hacks could help a lot with reducing your exposure to hacks and scams.

Share this article

Crypto Market Sentiment: How it affects token sniping strategies in bull and bear markets? Learn how crypto sentiment tools can help maximize sniping opportunities.

Discover how Noti’s Ethereum sniper bot helps you snipe ETH tokens, Ethereum meme coins, and more. Learn how to snipe tokens on ETH and stay ahead in the crypto market.

Explore the world of liquidity sniping in crypto trading. Learn what liquidity sniper bots are, how to use them effectively, and the strategies to master this essential trading technique.

Discover how Noti Sniping Platform transforms Web3 UX with its user-friendly approach. Explore the benefits of this intuitive crypto sniping tool and why it stands out in the world of complex crypto tools.

Learn how to identify and avoid meme coin scams and high-risk crypto coins. Discover essential tips for spotting fraudulent tokens and safeguarding your investments.

Don't miss out on the next big political memecoin! Get expert tips on investing and profiting in this wild market.

Get exclusive bonuses, free tips,

snipe tutorials, and project updates