Using a DeFi Sniper Bot Safely: Protect from Hacks, Scams and Frauds

Learn how to use DeFi sniper bots safely to protect your investments. Discover best practices to avoid hacks, scams, and frauds while navigating the DeFi ecosystem.

Like any asset, crypto can be traded up and down. There is profit to be made in both bull and bear markets. However, with token sniping, it’s somewhat trickier since it relies on purchasing an asset at its launch in the hope of profiting from the price pumping to the upside — making it a unidirectional play. And while crypto token sniping can and has been successful even in bear markets, it’s important to understand how market sentiment in each of the bull and bear markets affects token sniping.

At this point, the crypto market is mature enough to have many technical tools to analyze and predict price movements. Still, even sniping bots are programmed by humans. And human traders will always be at least partially influenced by their emotions. Few are immune from the dopamine high of the bull market or the low of the bear one. And when some traders are acting in a particular way, many others follow suit.

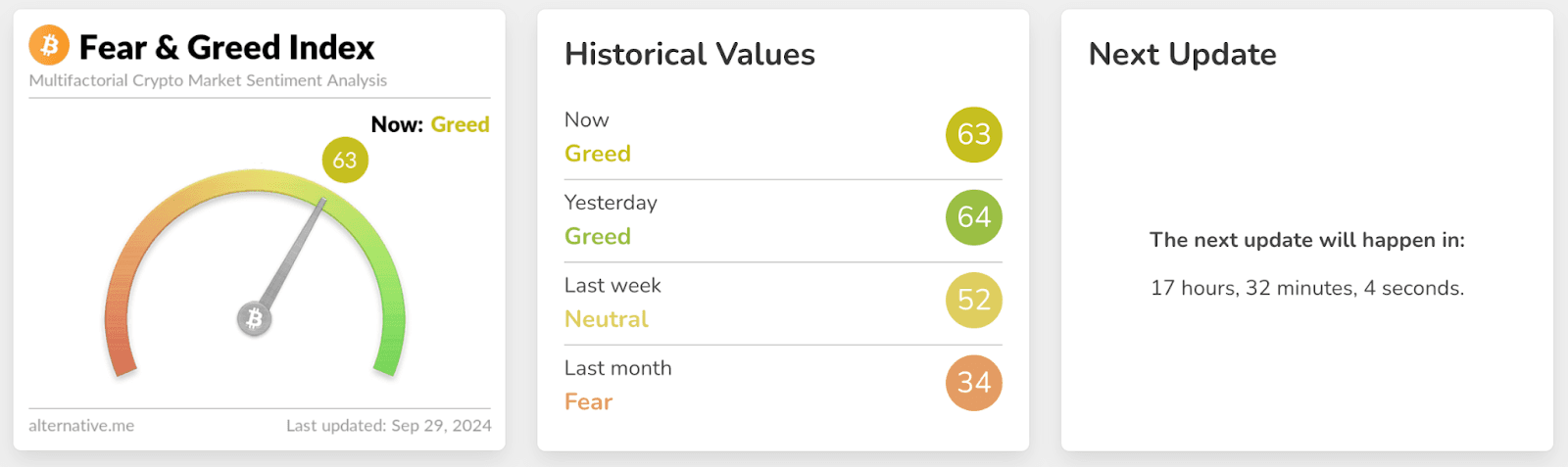

To quantify and better understand trader sentiment, there are a number of crypto sentiment analysis tools like funding rates and sentiment indices like:

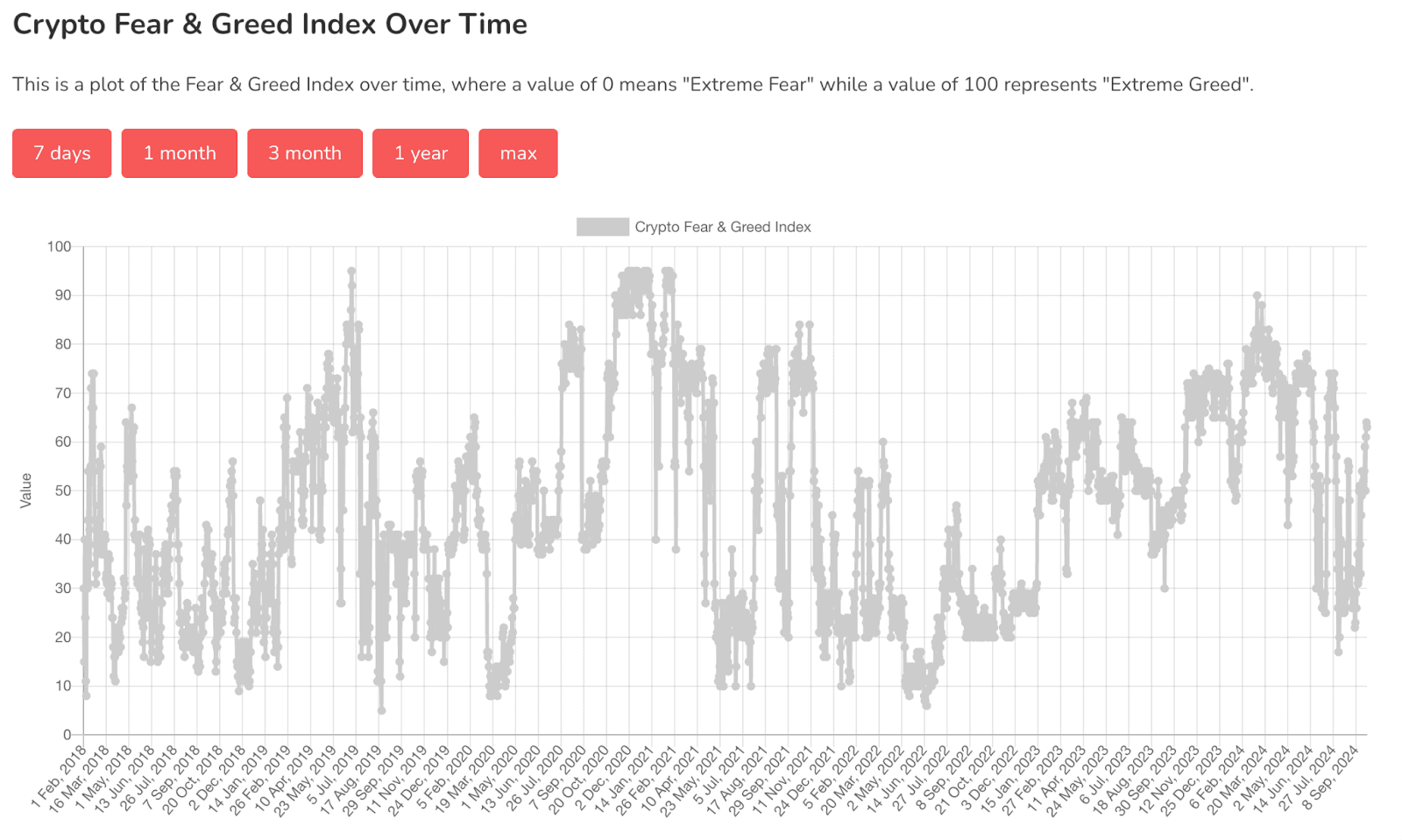

The Fear & Greed Index is a very popular crypto sentiment indicator, visualizing it in a way that’s easy to understand and appreciate via essentially a crypto sentiment score.

Unsurprisingly, bullish sentiment during a crypto bull run leads to explosive token sniping opportunities. Especially, once true bull market euphoria kicks in, everyone is looking for the next SHIB, BONK, WIF, and so on. This tends to positively influence both the longer-term price formation and the immediate spike in the token’s price in the minutes after the launch, making for particularly lucrative opportunities for the snipers who get their orders in the fastest.

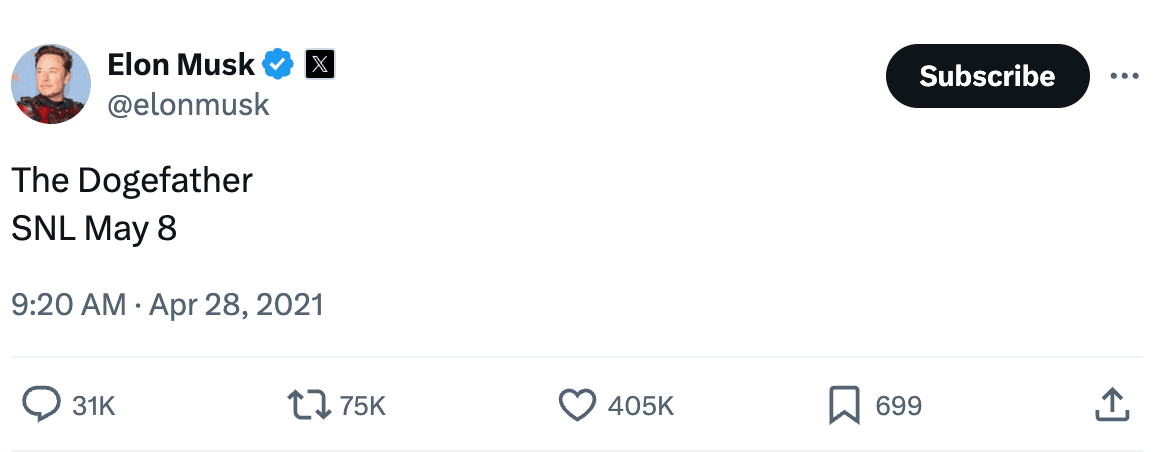

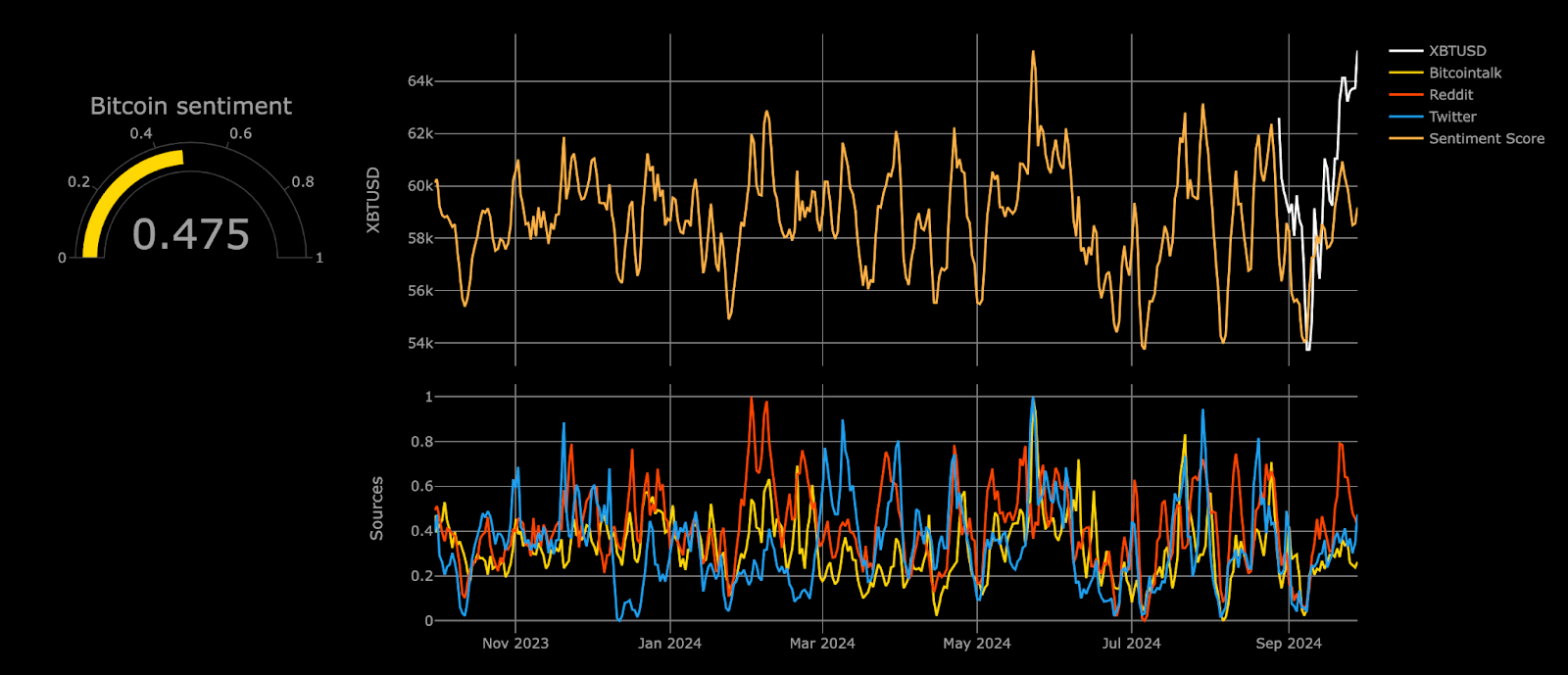

Let’s look at an example of how sentiment data and whale movements drive price surges.

On April 28, 2021, Elon Musk called himself The Dogefather on Twitter in promoting his SNL hosting gig — receiving 405k likes, 75k retweets, and 31k comments.

$DOGE price immediately spiked as much as 30%.

Note how the spike was followed by a retracement — a reminder that sentiment can be played both up and down.

Attentive sentiment watchers would notice how Elon’s tweet was just the peak of a months-long positive sentiment (hype even) around $DOGE on Reddit and other platforms, with the price surging by 400%, as can be seen in the above chart. $DOGE surged as much as 23,000% in 2021 because of all the hype. That is how far sentiment and influencer endorsement can take a crypto token in a bull market.

Crypto sentiment charts are especially important during bullish trends because the high volatility and velocity of bull market hype require the use of a crypto sentiment tracker. Interestingly, the previous bull market saw the fear & greed index spike to its highest Greed levels twice: once - as expected - at the peak of the bull market run but also 6 months earlier.

As can be seen in that crypto sentiment index, it spiked to high greed again in March 2024, just about 7 months ago. Does that mean that the market is due for another spike and/or a major bull run? Regardless of the answer, there are bound to be traders — and influencers — speculating on that question and driving prices with their sentiment. So consider various crypto trading strategies and be ready to act when the perfect opportunity arrives.

Bear markets introduce different levels of volatility and risk. “Price go up” is no longer a safe assumption, in fact, quite the opposite. How does a trader adapt sniping strategies for falling prices?

First of all, sniping horizons tend to shorten in the bear market. Without confidence that the newly launched token will defy the downward trend and appreciate significantly in price, it makes sense to put all of the sniping energy into those first minutes (hours at most) of the launch. It’s much less a game of speculators vs. HODLers that one could expect in the bull market, but is rather a game of speculator vs. speculator, sniper vs sniper.

It’s also important to leverage crypto sentiment analysis to avoid bear market traps. Because even the bear market has its bullish reversals. Many lose their entire capital betting too early on the turnaround, only to find themselves in a trap that reverts back to the general downward trend. Again, shortening time horizons is important here. Having tight control of the exit strategy is also crucial. Decide on the maximum acceptable loss and place stop loss orders there. Above all, make sure to use the best token sniping platform available to minimize risk and maximize the profits you can squeeze out of each snipe.

Token liquidity sniping works exceptionally well with sentiment because of the speed and the precision with which sniping bots can capitalize on even subtle changes in trader and influencer sentiment.

Token sniper bots work by placing and executing an order for a token before it is visible to the general public, capturing the earliest possible price. In bull markets, token sniping bots allow users to position themselves in the best way possible for the trader greed that follows a popular token launch. In the bear markets, the unparalleled execution speed and capabilities of crypto sniping tokens allow users to maximally shorten their trade exposure timelines to minimize the risks of a fear-driven collapse in the token’s price post-launch This is why they are essential in both bull and bear markets.

Because bots are computer algorithms with massive processing and data-access power they can respond to changing sentiment data in real time. This is especially true for the latest generation of sniping bots, which use specially-trained AI models to analyze market and social trends in order to predict possible risks and opportunities.

There are many popular tools for tracking crypto sentiment. Some are free or freemium:

And some are paid services:

While these various tools and sentiment crypto indexes are very powerful individually, they are infinitely more powerful when used together. Combining technical analysis with sentiment analysis improves decision-making, gives a much clearer picture of the trend behind the trend, and helps separate insight from noise in the next crypto bull run or its bear counterpart.

Let’s look at another real-world example of market sentiment shifts due to major news, in addition to the Elon Musk/DOGE one above.

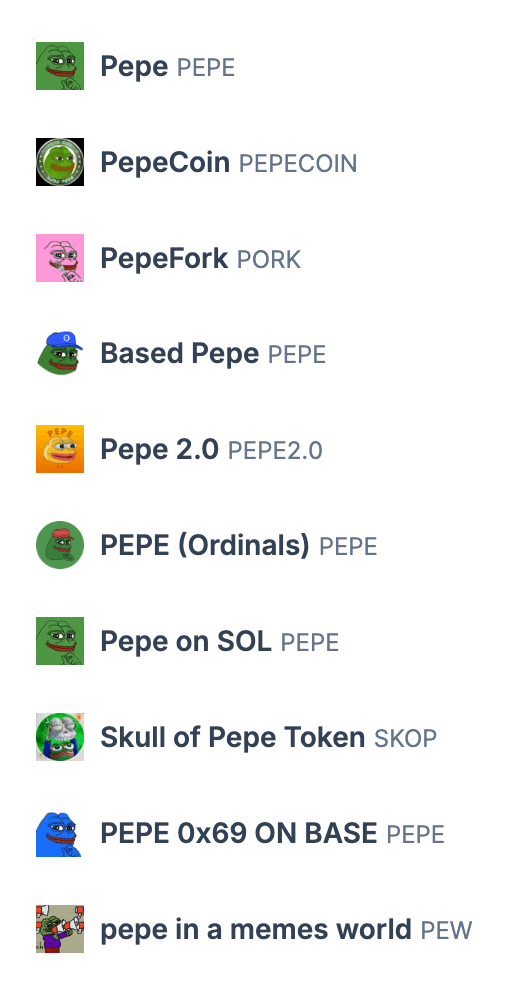

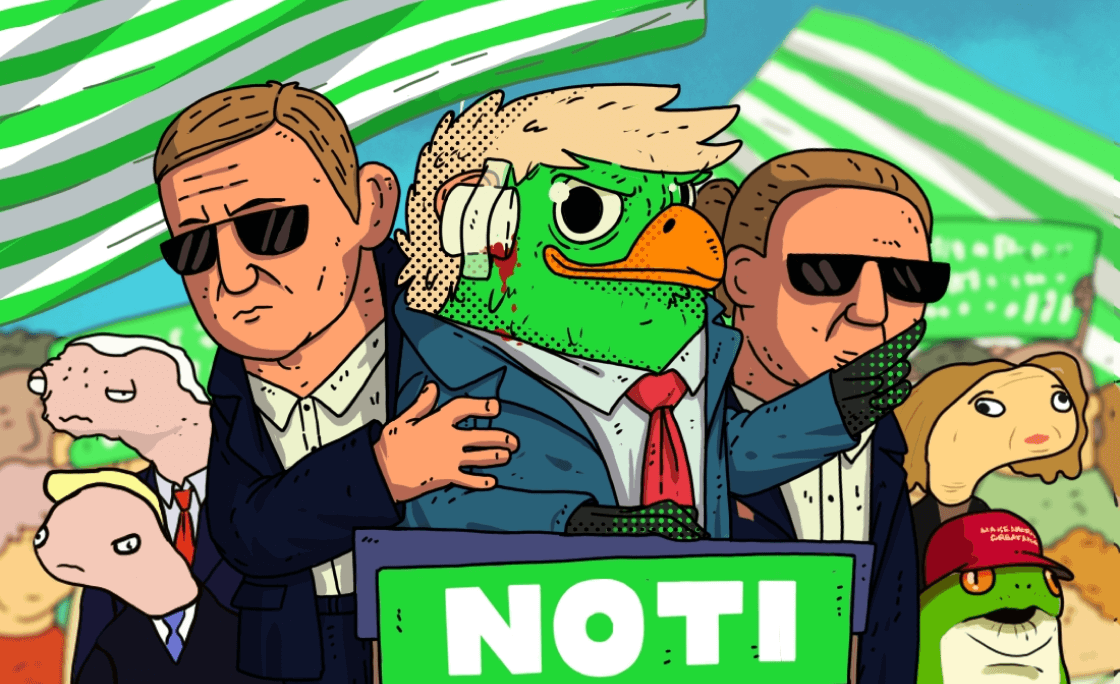

$PEPE is a massively popular memecoin based on a frog character that spawned countless memes. Pepe first saw the light in an online cartoon, Boy’s Club and in Myspace posts back in 2005 while also becoming an insider-joke in the Gaia Online community. Then, in 2008, Pepe made its way to 4chan, 8chan, and Reddit, soon becoming a popular meme for all situations, including antisemitic and bigoted ones. The social and political controversy only added to Pepe’s popularity, turning the cartoon frog into the perfect commentator meme for any viewpoint and identity.

It is therefore not surprising that the $PEPE memecoin had massive success right out of the gate, surging 2,000% in the first few weeks, reaching an insane $3.6 billion market cap at its height, and still trading at over 20,000% above its all-time-low.

Even long after its launch, $PEPE continues to be directly affected by sentiment and whale behavior. For example, when Arthur Hayes, former CEO of BitMEX, invested $250,000 in PEPE memecoins, it triggered an 18% surge in its price.

$PEPE’s success led to many copycat memecoins.

Some of them had significant pumps of their own. Some of them did not. A good crypto sniping tool like Noti can help traders get into and out of derivative copycats of all-star memecoins quickly, effectively, and securely enough to make very significant profits even if late to the original launch party for the $PEPEs of the world.

Successful snipes of $PEPE and its copycats in both bull and bear markets illustrate how traders can capitalize on news-driven sentiment using crypto sentiment data. At the end of the day, it’s the combination of the right analytics, the right sniping tools, and the discipline and experience to make the trades that minimize risks while maximizing profits.

Greed during bull markets creates a good environment for high price pumps when a token launches and makes even derivative or copycat tokens appear attractive based on hype alone. Fear during bear markets makes traders jump on any crumb of a profit opportunity, creating a good sniping environment for those who understand the crypto market sentiment today and are able to get in and out first.

There are a number of free, freemium, and paid tools available for sentiment analysis crypto trading, from Google Trends and CoinMarketCap to Augmento and Sentiment.

Absolutely. Sniping bots are even more useful in bear markets because of their ability to provide users with the best entry and exit into positions and execute orders in milliseconds. The latest generation of crypto sniping bots, like Noti, also have active MEV and rug-pull protection and market analytics essential to protect the users from losing their capital in the bear market.

Share this article

Learn how to use DeFi sniper bots safely to protect your investments. Discover best practices to avoid hacks, scams, and frauds while navigating the DeFi ecosystem.

Discover how Noti’s Ethereum sniper bot helps you snipe ETH tokens, Ethereum meme coins, and more. Learn how to snipe tokens on ETH and stay ahead in the crypto market.

Explore the world of liquidity sniping in crypto trading. Learn what liquidity sniper bots are, how to use them effectively, and the strategies to master this essential trading technique.

Discover how Noti Sniping Platform transforms Web3 UX with its user-friendly approach. Explore the benefits of this intuitive crypto sniping tool and why it stands out in the world of complex crypto tools.

Learn how to identify and avoid meme coin scams and high-risk crypto coins. Discover essential tips for spotting fraudulent tokens and safeguarding your investments.

Don't miss out on the next big political memecoin! Get expert tips on investing and profiting in this wild market.

Get exclusive bonuses, free tips,

snipe tutorials, and project updates