Using a DeFi Sniper Bot Safely: Protect from Hacks, Scams and Frauds

Learn how to use DeFi sniper bots safely to protect your investments. Discover best practices to avoid hacks, scams, and frauds while navigating the DeFi ecosystem.

CoinMarketCap values the cryptocurrency market at over $2 trillion. The market offers exciting opportunities to investors seeking to capitalize on digital asset trends and price movements, especially in the upcoming crypto bull run.

While it is theoretically accessible to everyone, with data insights indicating 560 million cryptocurrency users globally, some people are more enthusiastic about crypto than others. To this cohort, a trading strategy is king when maximizing success in the ever-dynamic industry.

Crypto trading has become a widespread investment practice among digital asset holders thanks to the allure of decentralization, 24-hour market availability, low entry barriers, transparency, and innovation in financial products.

However, there is more to crypto than meets the eye. Beyond these widely known benefits, digital assets are characterized by high volatility and are susceptible to several external factors that can influence dramatic price actions. These include supply and demand forces, media trends, global market outlook, and regulatory advancements.

These challenges make it necessary to leverage cryptocurrency market trading strategies, whether you’re a seasoned or beginner investor. By strategizing your crypto exposure, you can hedge against the risk of a market moving against you and maximize returns from positive movements.

That said, here are the top nine crypto trading strategies to get you started:

Suppose you’re intrigued by the potentially high-return narrative of the virtual asset landscape. In that case, fundamental analysis should be among your top strategies for navigating the industry’s waters, which can sometimes be murky.

As one of the most prevalent crypto trading strategies for beginners, fundamental analysis allows investors to research the underlying qualitative and quantitative factors influencing a digital asset’s intrinsic value. The strategy explores a project’s ins and outs, from its technology and team to the competitive landscape, prevailing market demand, and regulatory scrutiny.

Although key indicators in fundamental analysis can be exclusively tailored to suit a specific trading strategy, they are broadly categorized as below:

These include indicators reflecting the economic outlook in more established markets, such as stocks, but are adapted for digital asset relevance. Start by studying key data points such as interest rates to determine when investing in crypto is reasonable. For instance, higher interest rates are often less favorable for virtual assets as they dampen investor risk appetite, which can trigger prices to fall across the board, causing losses.

A good case study to elaborate on is the Bank of Japan’s recent move to hike its short-term interest rate to 0.25%. Bitcoin, the world’s largest crypto asset by market cap, responded to the market development by tumbling from $65,000 to $50,000 within seven days amid a broader sell-off. The sudden downturn saw over 200,000 traders liquidated, with an order on crypto exchange Huobi witnessing the most significant single liquidation of $27 million.

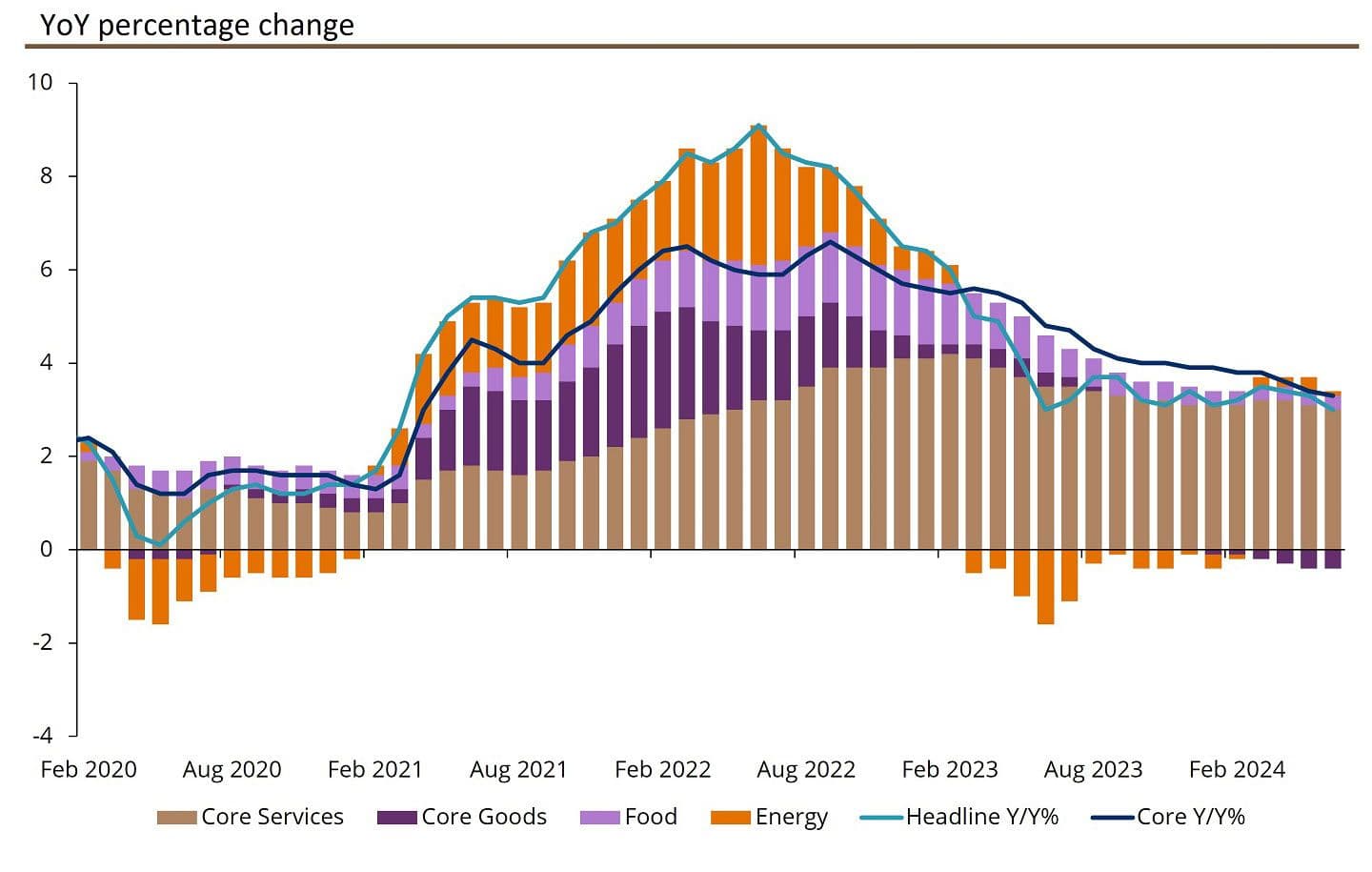

Another economic indicator to watch out for to boost your digital asset trading strategy is the monthly Consumer Price Index (CPI) data.

While the relationship between the CPI data and the crypto market isn’t always straightforward, this data point can influence prices in two ways. If the CPI data shows rising inflation, investors may be inclined to shift their money to digital assets as a hedge against the market downturn, causing crypto prices to rise. This might indicate an investment opportunity for traders.

On the contrary, if the CPI data indicates declining inflation, investors may withdraw funds from crypto and take positions in other assets, such as stocks and bonds. This might cause a price plunge across the virtual asset market, signaling a time to slow down trading.

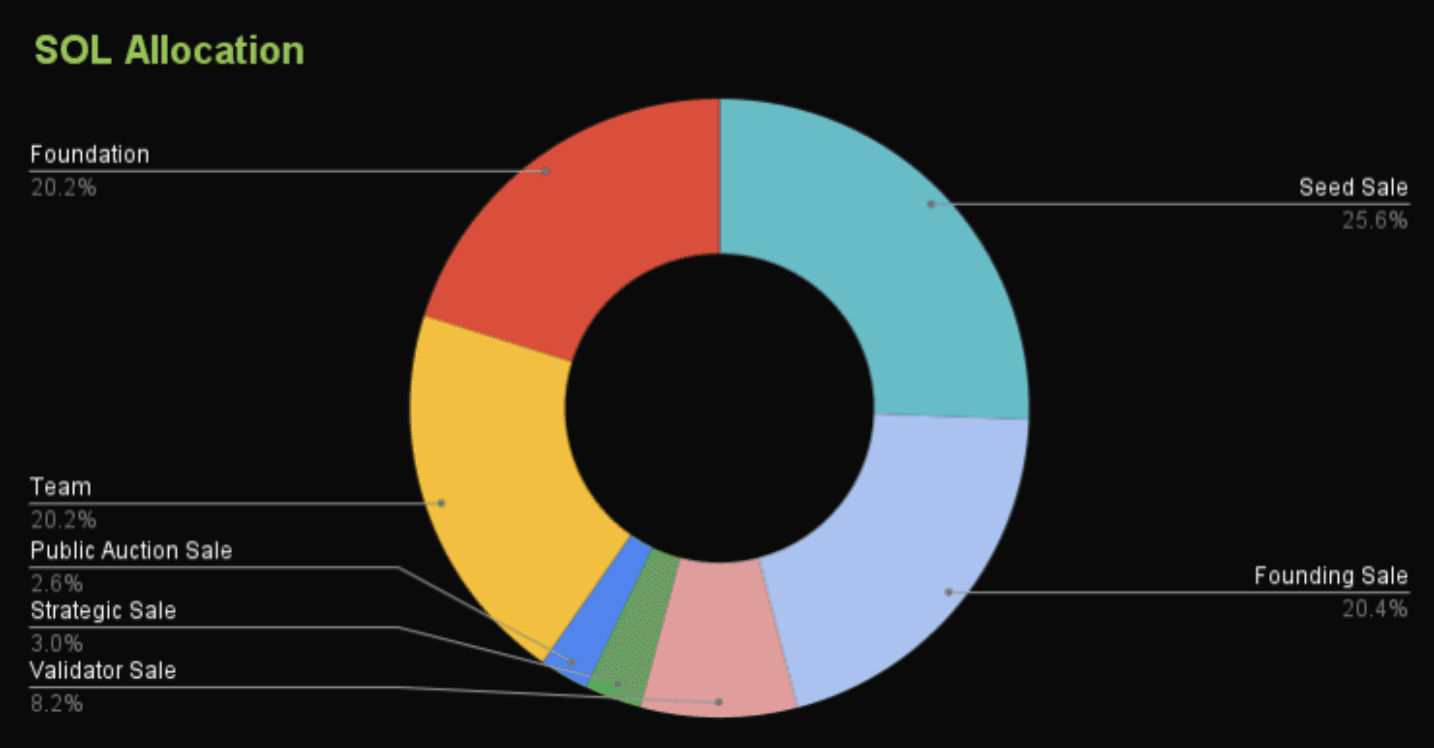

Watch out for the token allocation schedule to avoid falling for prevalent crypto investment risks, such as rug pulls. Projects that directly control over 25% of their token either by themselves or through proxy early-stage investors might not be worthwhile to include in your cryptocurrency trading strategy. This is because the exclusive holders, especially when favored by a short-term vesting period, could all sell if the asset pumps, leaving newcomers to brace for a massive price fall.

This means projects with even token allocation across the community and more extended vesting periods could be seen as more attractive for investment as the token’s distribution schedule is geared toward driving its success.

For context, let’s explore Solana’s SOL distribution.

Per the chart above, the initial distribution of SOL tokens included 12.5% to the Solana Foundation and 12.5% to team members. This means people directly involved with Solana controlled less than 25% of the tokens, making SOL attractive for investment. SOL is up nearly 500% in the last year.

Another key indicator to consider during fundamental analysis includes specific metrics that help gauge a crypto asset’s usage and adoption levels, which indirectly correlate with the underlying value. For instance, an asset with a high transaction volume, preferably averaged daily, weekly, or monthly, could be highly utilized and in high demand, signaling investor interest.

The same applies to digital assets with an explosion in active wallet address growth, potentially indicating heightened investor participation or wider acceptance.

News and social media feeds often drive cryptocurrency prices, making these indicators worthwhile to watch out for as part of your strategies for trading. Research a project’s social channels to stay updated on big collaborations, market sentiment, and regulatory changes involving the digital asset. Most importantly, ensure that the engagement levels are organic and free of rampant bots deployed to disguise an unscrupulous project as popular.

Fundamental analysis can only be as good as you make it. For starters, here are the benefits and downsides you could face with this strategy for crypto trading:

Pros:

Cons:

Let’s borrow an example from a prolific crypto trader and content creator on X (formerly Twitter), the “Crypto Guts.” The trader conducted an in-depth fundamental analysis of the privacy-focused blockchain Oasis Protocol and its token $ROSE. Here is the process he followed:

This analysis helped the trader understand the project's strengths and weaknesses from an investment perspective, ensuring improved decision-making aligned with personal risk tolerance and strategies for trading.

Unlike fundamental analysis, technical analysis is a cryptocurrency trading strategy that generally uses numbers to evaluate an asset’s market performance.

Technical analysis examines a digital asset’s historical price data and trading volumes to extract patterns and trends pointing to future price action. At its core, the strategy helps beginner and pro investors identify entry and exit points, manage risk, and formulate investment plans based on price fluctuations.

Technical analysis borrows heavily from Charles Dow, whose revolutionary Dow Theory laid the foundation for what has now matured as sophisticated methods of analytical techniques. The top indicators for this trading strategy include the following:

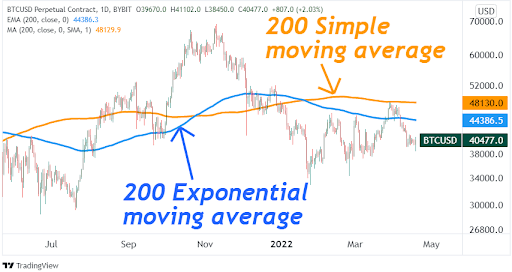

Crypto traders often leverage moving averages indicators to smooth out price data points over a certain duration, thus highlighting a clearer view of a possible trend direction. By analyzing price interactions between long-term and short-term moving averages, such as the 200-day and the 50-day, investors can unearth discerning signals for presage market downturns (death cross) or upswings (golden cross).

At the same time, observing other types of moving averages, such as Exponential Moving Averages (EMA) and Simple Moving Averages (SMA), can help you identify key support or resistance levels in a digital asset’s price.

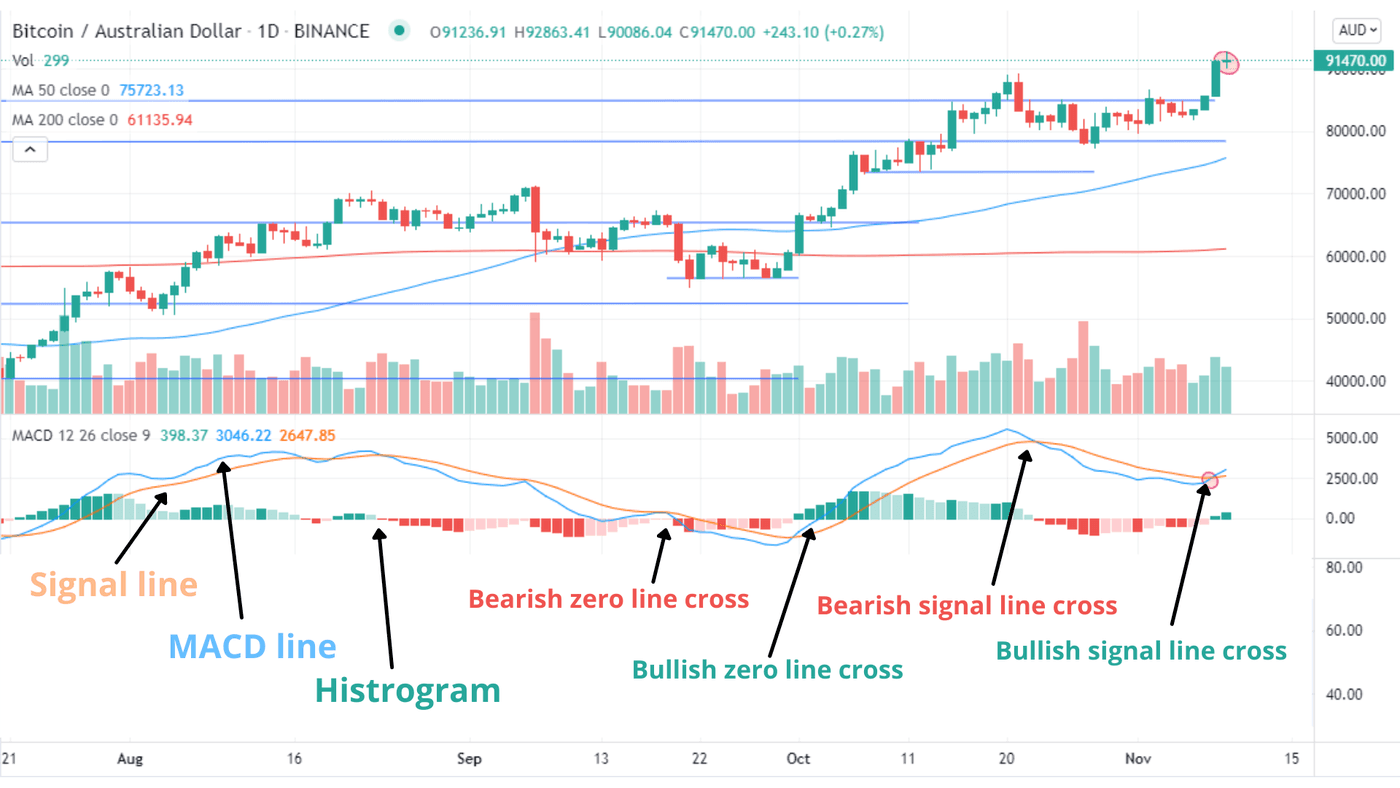

The MACD indicator combines two moving price averages to track their relationship for potential upward trends and value reversal. You can leverage this indicator by finding the difference between longer-moving average values and short ones with MACD lines that indicate potential buy or sell opportunities through crossovers with their signal line.

The histogram indicator above represents the difference between the signal line and the MACD to show the strength and direction of the trend in question. This indicator rises above the zero line to indicate a bullish trend and below it if the pattern turns bearish.

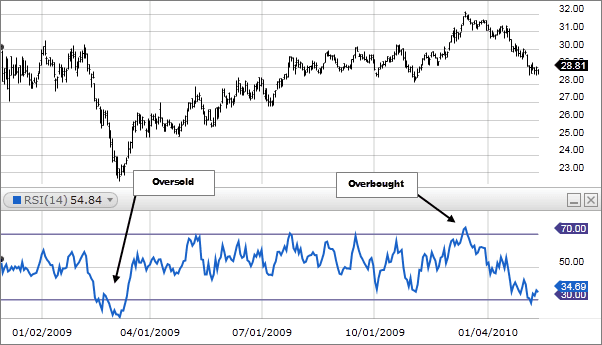

Developed by J. Welles Wilder Jr, the Relative Strength Index (RSI) is an essential market indicator for identifying oversold or overbought opportunities, making it necessary in crypto trading.

Typically, the RSI oscillates from 0 to 100, with values above 70 considered overbought and those below 30 oversold. While oversold market conditions might signal a potential price surge in the short term, an RSI depicting overbought conditions indicates that prices might plunge in the short term. This can help you evaluate opportune entry and exit points for your trading strategies.

Calculating RSI is quite complex, but beginners can get started with this RSI formula to gauge price gains and losses over a certain duration:

RSI = 100 – [100 / (1 + (Average of Upward Price Change / Average of Downward Price Change)]

Chart patterns and trends complement technical analysis indicators by depicting what’s happening beneath the market signals. Prevalent charts and trends to watch out for as you spruce up your cryptocurrency trading strategy include:

The Doji single-candle pattern visually embodies a thin line with wicks on one or both ends. Its distinctive appearance is characterized by open and closing prices that are nearly similar or close to each other, forming a plus or cross sign.

The length of shadows in the cross or plus sign created by a Doji candle can vary; hence, various types of Doji patterns exist. This includes neutral Doji, gravestone Doji, long-legged Doji, dragonfly Doji, and others.

A Doji pattern typically forms when a digital asset’s supply equals the prevailing demand, creating a scenario where neither users nor buyers can gain. This might indicate a potential continuation or reversal of the existing trend, depending on other macro factors that might trigger price action.

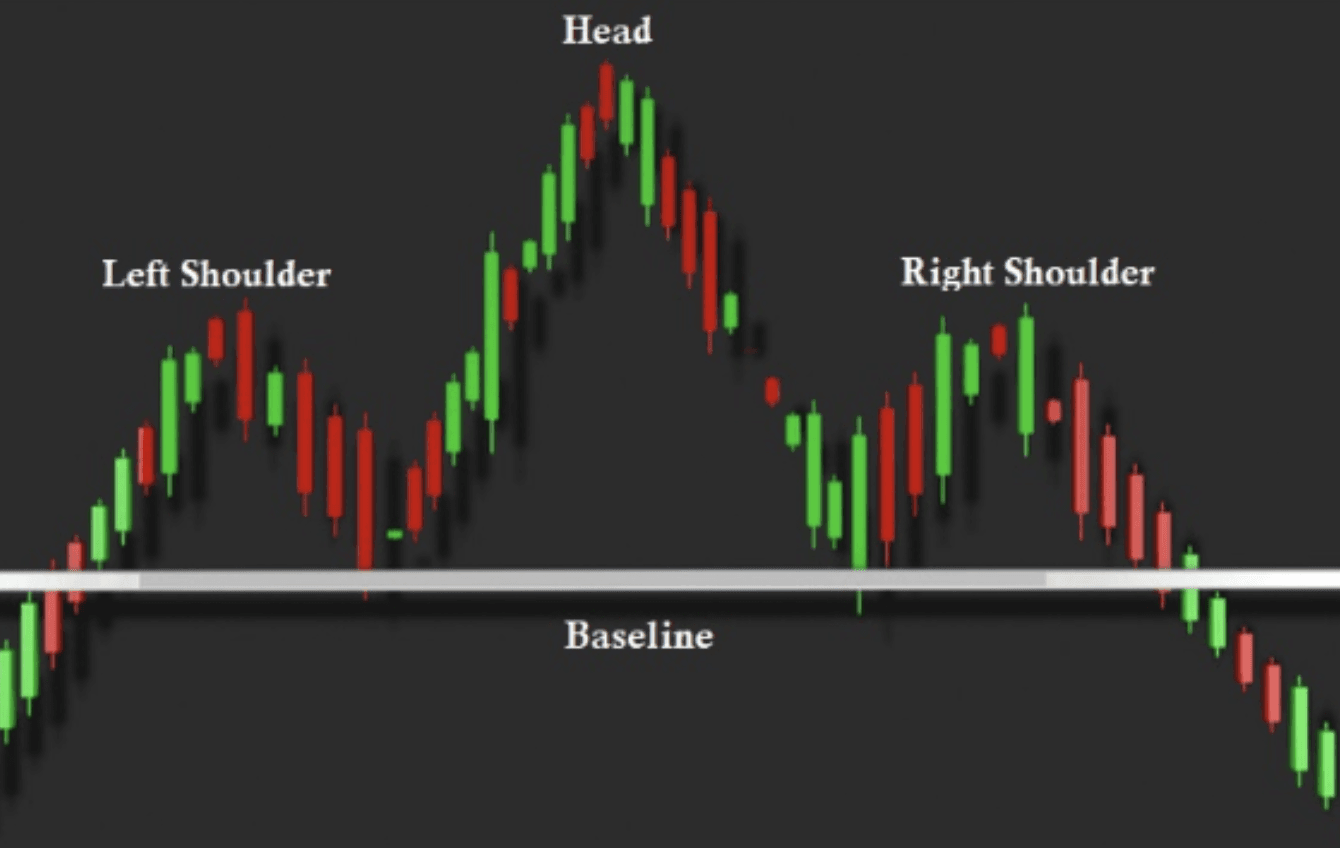

The head-and-shoulders pattern is popular in pro and beginner cryptocurrency market trading strategies. It comprises three peaks on a horizontal line arranged to mimic a physical head with two protruding shoulders (in a human context).

After a prolonged rally, the pattern forms when a crypto asset’s price hits a resistance level to pare some gains and retreat toward the baseline, creating the left “shoulder”. The prices then surge higher than the first round before falling to form the “head.” This is followed by another mild price surge and drop to create the right “shoulder”, as seen in the chart above.

The head-and-shoulders pattern is a reliable predictor of market turning points, which could signal a trend reversal. In the case of an inverse head-and-shoulders pattern, go bullish on your trading strategy.

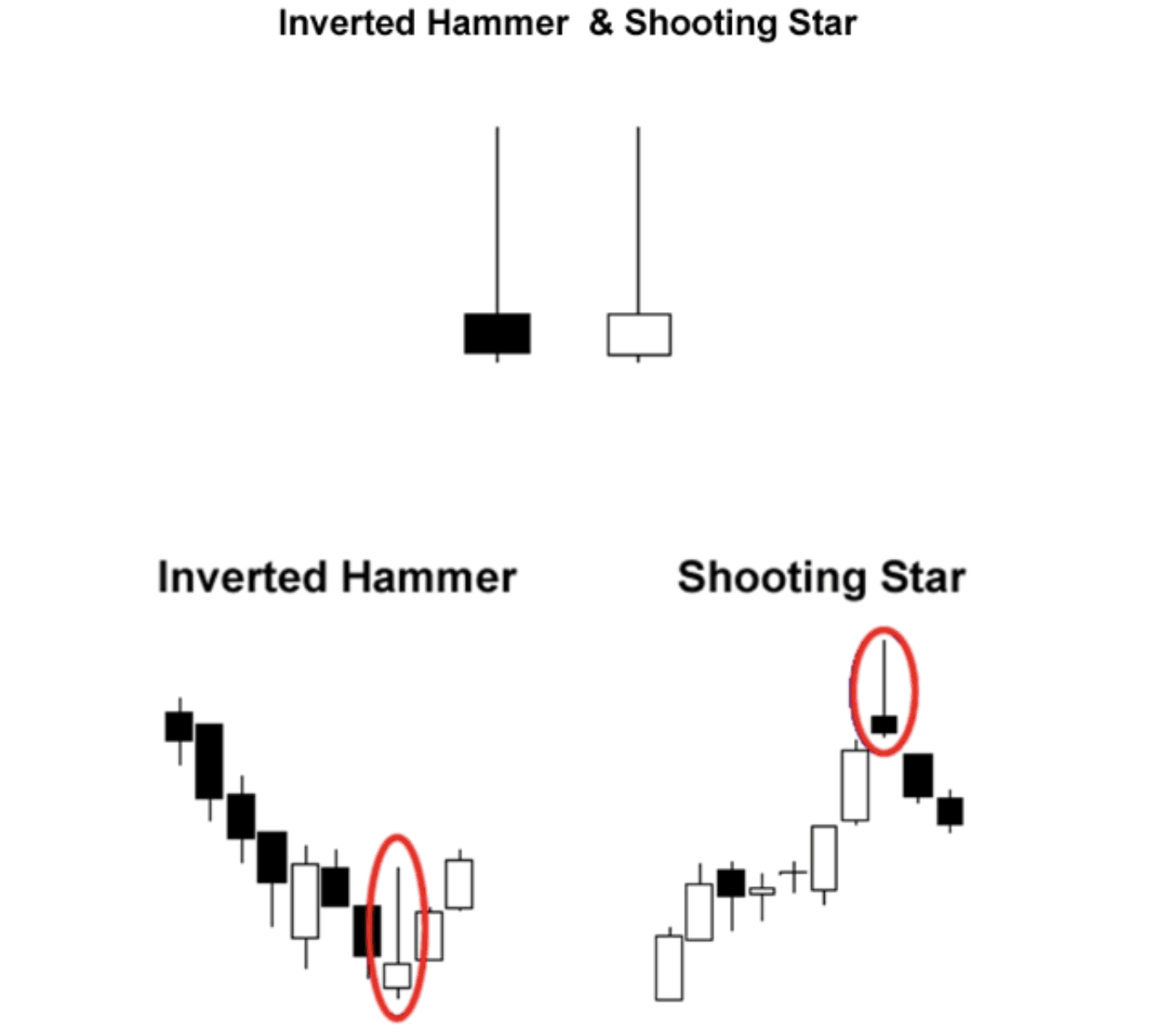

Presented as mirror images, the shooting star and inverted hammer are part of the broader single-candle chart patterns used to unravel powerful patterns for better insights into market dynamics. The Shooting Star features a small lower body and a long upper wick, usually occurring in an uptrend. The pattern signals potential downward movement, suggesting a sell or short position.

On the contrary, the Inverted Hammer is found in downtrends but has a long upper wick for forecasting trend direction. This pattern often signals a potential upward swing, allowing traders to seize a buying opportunity.

Like other crypto trading strategies, technical analysis has its upsides and drawbacks, including:

Pros:

Cons:

Bitcoin enthusiasts on X, BitMara, recently conducted a technical analysis of Bitcoin’s price to determine whether the crypto asset was bullish, an indication that often prompts many to buy. The trader analyzed a descending broadening wedge accumulation pattern to establish their findings.

The pattern is usually indicative of a potential bullish reversal pattern. In this case, it pointed out that Bitcoin’s price was about to break upwards after a downward trend. Per the pattern, the downward momentum is weakening as the lower trendline flattens out, which suggests dwindling selling pressure. Based on this observation, investors might buy the crypto asset when its price flirts with the lower levels within the wedge in anticipation of a surge.

One of the most sought-after trading strategies for the crypto bull market is token snipping. Tools that facilitate this technique have become popular among retail investors seeking to bolster their competitive moat with the ability to execute transactions at lightning-fast speeds, often in milliseconds.

Crypto sniping is an investment technique that leverages an automated computer program (bot) to capitalize on sudden price action surrounding early-stage tokens before they hit the market. Packed with advanced artificial intelligence (AI) capabilities and algorithms, the bot monitors blockchain transactions to execute simultaneous buy and sell orders based on predefined criteria. This allows investors to maximize gains by responding to market action near-instantly before other traders.

To understand better how crypto sniping bots work, reflect on what a real “sniper” does in the military context. They gather intelligence during reconnaissance, mark targets, and execute the killing shot. A sniping bot does the same to early-stage tokens but in a more refined way. Here is how a token sniper bot works in four steps:

One of the most advanced tools in the market that has proven to provide user-friendly crypto trading strategies for beginners is the Noti Bot. The Noti sniping platform can be accessed via a web application, Telegram bot, or API integration for pro investors.

Like any other trading strategy for beginner or pro investors, the Noti sniping bot has unique advantages and drawbacks.

Pros:

Cons:

The day trading strategy has become popular among crypto investors seeking immediate returns without the need to maintain overnight exposure to market risks. Unlike long-term investors, day traders are fast-paced and often leverage advanced software tools or platforms to enter and exit positions swiftly.

The U.S. Financial Industry Regulatory Authority’s margin rule defines day trading as buying and selling assets on the same day in an attempt to gain from small price movements. In a crypto context, this involves opening and closing digital asset positions within a day or two, given that the cryptocurrency market never sleeps.

Depending on your ability to conduct technical and fundamental analyses, you can get started with various day trading strategies for cryptocurrencies, including:

Capturing pivot price points during day trading is a popular strategy for investors seeking to prepare for long positions while maximizing intraday gains. Crypto assets like Bitcoin often retest key price levels during market corrections before returning to daily highs, allowing day traders to profit from the rejuvenated upward trajectory.

This technique involves riding on a crypto asset’s momentum during the day for a potentially fast profit. While many may interpret this strategy as “buying low” and “selling high,” innovative investors have another way of doing it. They often buy what’s already highly priced in the market and sell it when the value breaks out higher. An asset with bullish momentum attracts increased trading volume, positioning its price to rise quickly.

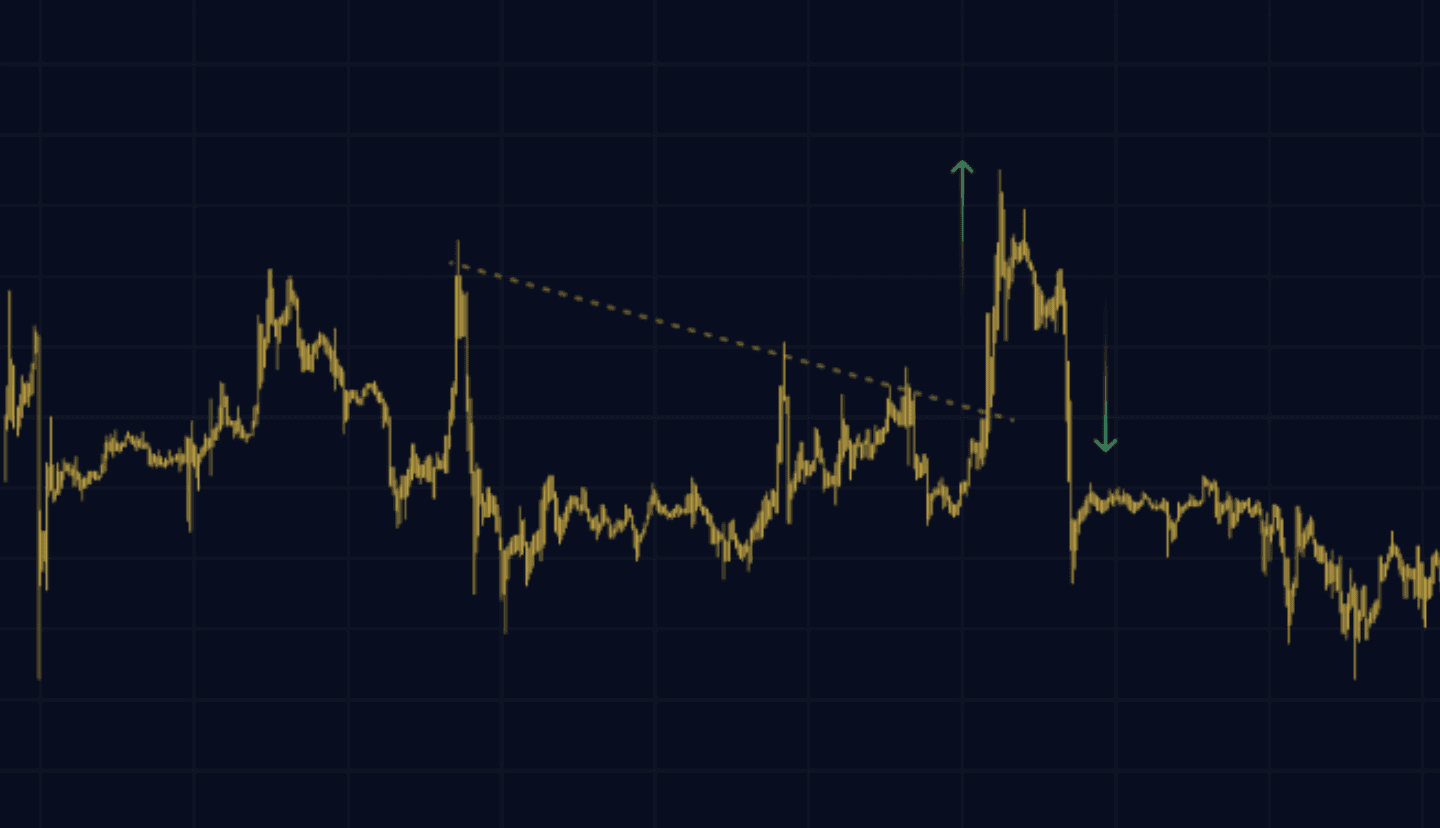

A breakout is a rapid price action propelling a cryptocurrency’s value beyond chart formation or consolidation boundaries.

The example above shows a price breakout that happened fast and ended quickly. For a day trader, this could have presented a potentially lucrative opportunity to maximize profits in under 24 hours, especially if a tool with an automated short stop-loss function was employed. However, it’s important to note that this technique is highly reliable during the crypto bull market.

Another strategy for crypto day trading is investing based on the prevailing industry trends in price movements. For instance, you can leverage moving average indicators to identify the short-term breakouts of a digital asset’s price and capitalize on the trend to buy the slight dip and sell when the initial value rebounds.

The crypto market’s innovation has seen the rise of many tools and platforms supporting day trading. They include digital asset trading venues and exchanges with advanced charting features, such as Binance, Kraken, KuCoin, and Coinbase Pro. Alternatively, you can leverage a dedicated crypto charting software like TradingView, especially if you’re a high-frequency day trader dependent on complex indicators like RSI and MACD.

The advantages of crypto day trading outweigh the kickbacks:

Pros:

Cons:

Swing trading is among the widely used strategies for trading digital assets, especially among newcomers to the industry. Unlike fast-moving techniques, swing trading offers generous time horizons, giving investors ample time to ponder their next step and make decisions prudent decisions under little pressure.

As the name suggests, swing trading is an investment technique that entails tapping into the “swings” or fluctuation of digital asset prices to seize profits within a short duration. The strategy is geared toward capitalizing on prolonged market volatility that lasts within a few days, weeks, or sometimes months.

Becoming a crypto swing trader can be a rewarding experience if you follow prevalent strategies with a high potential for explosive return when deployed well. For instance, you can:

As the name suggests, this strategy involves keenly watching the market to monitor sentiment and volume around popular tokens. The trick lies in opening positions during the early stages of a trend formation, ensuring that you’re aligned with the “crowd” before it gets too big and mass momentum around the asset dwindles eventually. However, the decision to exit is also critical and should be made while the crowd still drives the trend upward.

This strategy entails capitalizing on digital assets with a history of “pulling back” to high levels after they sink below key support levels. That way, you can buy the asset at its lowest level and offload it once the upward trajectory resumes and the desired price target is reached. You can leverage prevalent indicators, such as Fibonacci Retracements, to accurately identify optimal buying zones based on historical price behavior patterns and your investment goal.

This swing strategy aims to position you to “catch the wave” of an appreciating asset and take profits from the upward movement before a pullback, buoyed by market correction or other external factors. One way of doing this is by applying the moving average technique to identify a series of averages of various subsets or data points.

An area where swing trading and day trading are similar is the type of tools and trading platforms that facilitate strategies built around them. This includes established crypto exchanges like Binance, KuCoin, and Coinbase as well as advanced dedicated charting platforms like TradingView.

Understanding the ins and outs of swing trading before adding it to your crypto investment strategy is imperative. Here are the benefits and drawbacks:

Pros:

Cons:

Scalping strategies have gained traction in crypto trading, especially among investors seeking to leverage tiny price movements and snag profits on multiple assets.

Scalping is an advanced investment technique that deploys a high volume of trades to capitalize on brief periods of high market volatility. The strategy relies on making several daily trades to exploit mild price gaps based on chart analysis, order books, cluster analysis, and densities.

Examples of effective scamping strategies employed by seasoned and beginner traders include:

This strategy allows you to scalp crypto assets for quick, small gains when prices oscillate between clear support and resistance levels. The trick is to buy when the price drops towards a support level and sell quickly when it notches higher toward the resistance level. However, it’s worth noting that range trading is premised to be more successful when you leverage tight stops below support on buys and above resistance on sells.

Watch out for overbought or oversold crypto assets using signals like RSI divergences to get started with this technique. To increase the chances of profiting, enter trading positions during pullbacks after the initial reversal candle and exit on subsequent moves in the reversal direction.

The momentum ignition technique in scalping demands that you watch out for price breakouts in charts and patterns like wedges and triangles. This is followed by targeting a risk or reward ratio of 1:2 or 1:3 immediately after the initial breakout surge and closing the partial positions to lock gains once the trade moves in the desired direction.

The best tool for this strategy is a scalping bot, which can be deployed to various trading platforms, including centralized and decentralized exchanges. An ideal scalping bot should be reliable and able to handle high-frequency trading with zero to insignificant downtimes. Most importantly, it should feature advanced security to safeguard your trading data and funds.

Scalping has various benefits and drawbacks, including:

Pros:

Cons:

Arbitrage makes one of the most user-friendly crypto trading strategies for beginners, thanks to its low-risk mechanism. Additionally, anyone can get started with this method regardless of their skills in fundamental analysis, technical analysis, or sentimental analysis. All you need to do is identify opportunities and act on them swiftly.

Crypto arbitrage is a technique investors use to gain from the price difference of a digital asset across multiple exchanges. Typically, this happens by buying the digital asset from an exchange where it’s priced lower and selling it on a platform where it’s priced higher. Various factors can influence price discrepancies, including market volatility, a supply and demand imbalance, or varying price discovery methods.

Basic arbitrate strategies that can be applied to a wide range of cryptos in the market include:

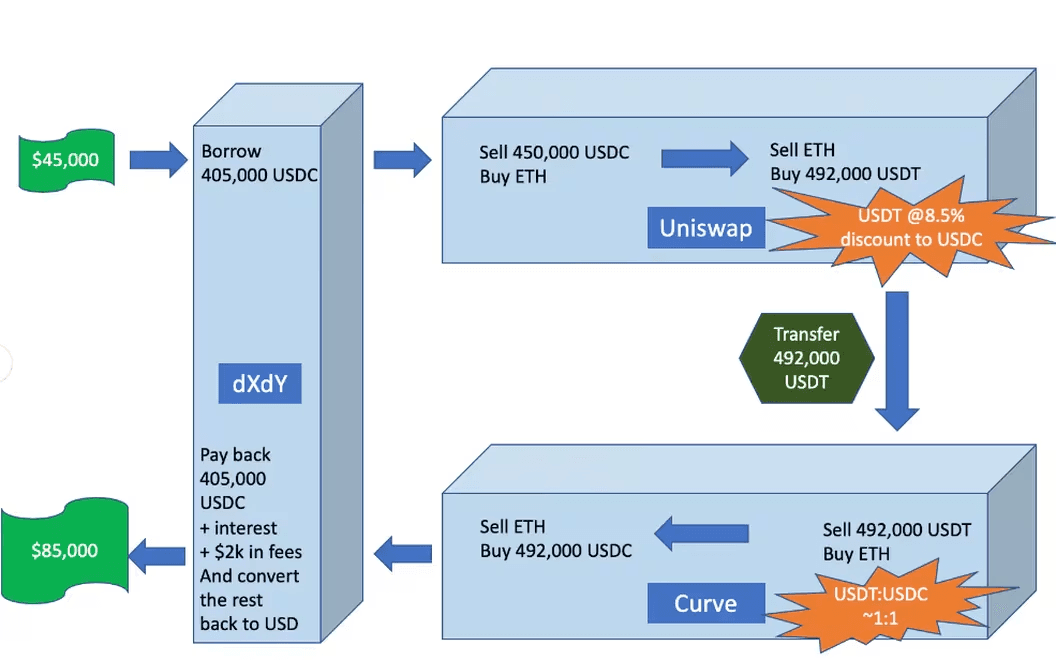

DeFi arbitrage is an advanced trading strategy that takes advantage of the differences in a crypto asset’s price, interest rate, or exchange rate across multiple decentralized finance protocols. Unlike standard arbitrage techniques, this strategy demands an in-depth understanding of the DeFi landscape to initiate complex, interlinked trades, as shown in the diagram below:

As the name suggests, this technique relies on gaining from the funding rate differential on various digital asset derivatives trading platforms. With this strategy, a trader deploys the arbitrage bot on perpetual contracts to execute buy and sell orders according to the funding rate of individual contracts.

The bot takes long positions when the funding turns positive to allow profit-taking and short positions when the funding rate turns negative. In other words, this strategy allows you to enter long and short positions depending on what is profitable in the prevailing market conditions.

Intra-exchange arbitrage is simple because it happens within the same trading platform, allowing users to capitalize on the price difference of a digital asset across different investment products. For instance, you can leverage the price difference between a digital asset’s price in the spot market and its futures price on the same trading platform.

Often compared to cross-exchange arbitrage, this technique leverages the price difference of a virtual asset at exchanges located in different regions. In this case, the trader exploits the spread value of the digital asset to earn profits, but the gains might quickly lose value as shifting assets across exchanges may take time.

Arbitrage opportunities might last for a few minutes, if not seconds, making using advanced trading tools such as automated arbitrage bots necessary. Unlike humans, these tools can research and discover nearly every arbitrage option in the market with little effort and no emotional bias. These tools can be deployed to various trading platforms, including Binance, KuCoin, Coinbase, Kraken, Uniswap, and others.

The advantages and disadvantages of leveraging arbitrage as a cryptocurrency trading strategy include:

Pros:

Cons:

Unlike traditional stocks and bonds, cryptocurrencies trade around-the-clock, seven days a week, making them attractive to those seeking highly profitable opportunities. Traders have turned to automated trading strategies to capitalize on this opportunity.

Automated crypto trading is an investment technique that involves leveraging specialized software to buy and sell digital assets when the predefined conditions are met. In other words, the programmed software (bot) exploits price movements to maximize gains without human intervention.

Automated crypto traders have a competitive edge because bots allow them to analyze a much larger data pool faster and execute traders more precisely. Here are some of the popular tools to get you started with this investment technique:

Binance, the world’s largest crypto exchange by trade volume, is the best place to start if you want to employ automated trading strategies for digital assets. In addition to providing in-built automated trading services, the exchange supports over 87,000 auto bots created by independent developers.

You might want to consider Bybit trading bots if you’re into crypto derivatives trading. The exchange offers a massive bot marketplace, allowing you to choose from various software tools that suit your strategy. Popular options that support crypto auto trading on the platform include Futures Martingale, Futures Combo, DCA, Spot Grid, and Futures Grid.

Since its inception in 2018, MEXC has offered some of the most advanced bots for automated copy trading on its centralized exchange platform. The bot allows you to filter pro traders based on their number of followers, profit and loss (PNL) rate, win rate, and return on investment (ROI). The copy trading bot is free with no minimum investment requirement.

Setting up an automated trading strategy for cryptocurrencies is a structured process that entails choosing the right bot, defining investment parameters, and implementing continuous monitoring to ensure desirable outcomes.

What do you want to achieve with crypto trading? The answer to this question should help you formulate a strategy that aligns with your desired financial goals. Popular strategies that you can choose from include day trading and swing trading.

Choosing the right tool hinges on various factors, including individual investment needs and goals. That said, watch out for a bot that offers all the standard features of a traditional automated tool plus extra functionalities to give you a competitive edge. This includes extensive customization and integration with all popular trading platforms.

Connect your tool to a crypto exchange using an API if you’re a pro trader. Some automated bots will allow you to launch the tool via a web platform or Telegram bot for seamless integration with DEXs. Refer to the developer’s guide if you’re stuck.

Leverage historical data on your trading platform to test the bot’s efficiency before adding other customizations. This will help you gauge whether the tool functions as advertised in speed, accuracy, and user-friendliness.

Based on the testing results of step 4 and the trading strategy defined earlier, predefine the specific triggers and indicators that would trigger the bot to execute buy and sell orders automatically.

One way to succeed in automated trading is to know when to take profits. While this might vary depending on your investment goals, it’s advisable to harvest gains regularly to minimize exposure to long-running price fluctuations.

Automated trading comes with its share of pros and cons:

Pros:

Cons:

HODL is a crypto slang term derived from a misspelling of “hold” in the context of buying and keeping digital assets for long-term gains. Interestingly, the term was coined from a typo of “holding” in a 2013 online post on the Bitcointalk forum, where a user encouraged people not to sell BTC following its meteoric rise from $130 to $950 in under eight months.

In today’s crypto landscape, HODL is seen as an acronym for “hold on for dear life,” which implies not selling your crypto assets when the market is rattled or volatility ensues. The strategy stems from the belief that regardless of the prevailing market conditions, digital assets will hold their value over time and appreciate significantly.

HODLing is one of the most popular strategies for crypto trading, thanks to the numerous benefits it presents, including:

The biggest advantage of HODLing is simplicity. As an investor, regardless of your technical skills, all you need to do is buy the digital asset of your choice and store it in a Web3 wallet. After that, you watch the asset appreciate without your intervention or the need to constantly monitor shifting market trends.

One factor that has led to the rise of many protocols and layer-2 chains in the industry is the need for relatively affordable transaction costs. Buying and selling cryptos amid price fluctuations can be a costly experience, especially when gas fees pile. Fortunately, long-term HODLers don’t need to worry about endless gas fees as they only sell once after holding for months, sometimes even years.

Although digital assets are susceptible to market volatility, traders can minimize the impact of this phenomenon by holding their assets for long-term gains. This means protection against rapid and sudden fluctuations that may influence emotionally driven decisions, ensuring that you maximize returns.

Although HODLing has evolved into a popular strategy employed by both retail and institutional crypto investors, it poses various risks, including:

Cryptos are generally volatile, meaning every investor is exposed to the phenomenon in one way or another, regardless of the trading strategy. Long-term HODLers may witness sudden price movements or dramatic fluctuations, which can take a toll on the value of their digital assets. The situation can be worse in the event of a prolonged market downturn.

HODLing cryptocurrencies for potentially long-term gains comes with added security responsibility. You’ll need to employ standard and advanced security measures to safeguard your custodial or non-custodial wallet from unauthorized access, phishing attacks, and other cyber intrusion. Failure to do this might result in unimaginable losses.

HODLing mature digital assets such as Bitcoin and Ethereum could mean having your money tied up in one place, leaving you with limited capital to seize other potentially profitable opportunities in smaller cryptos.

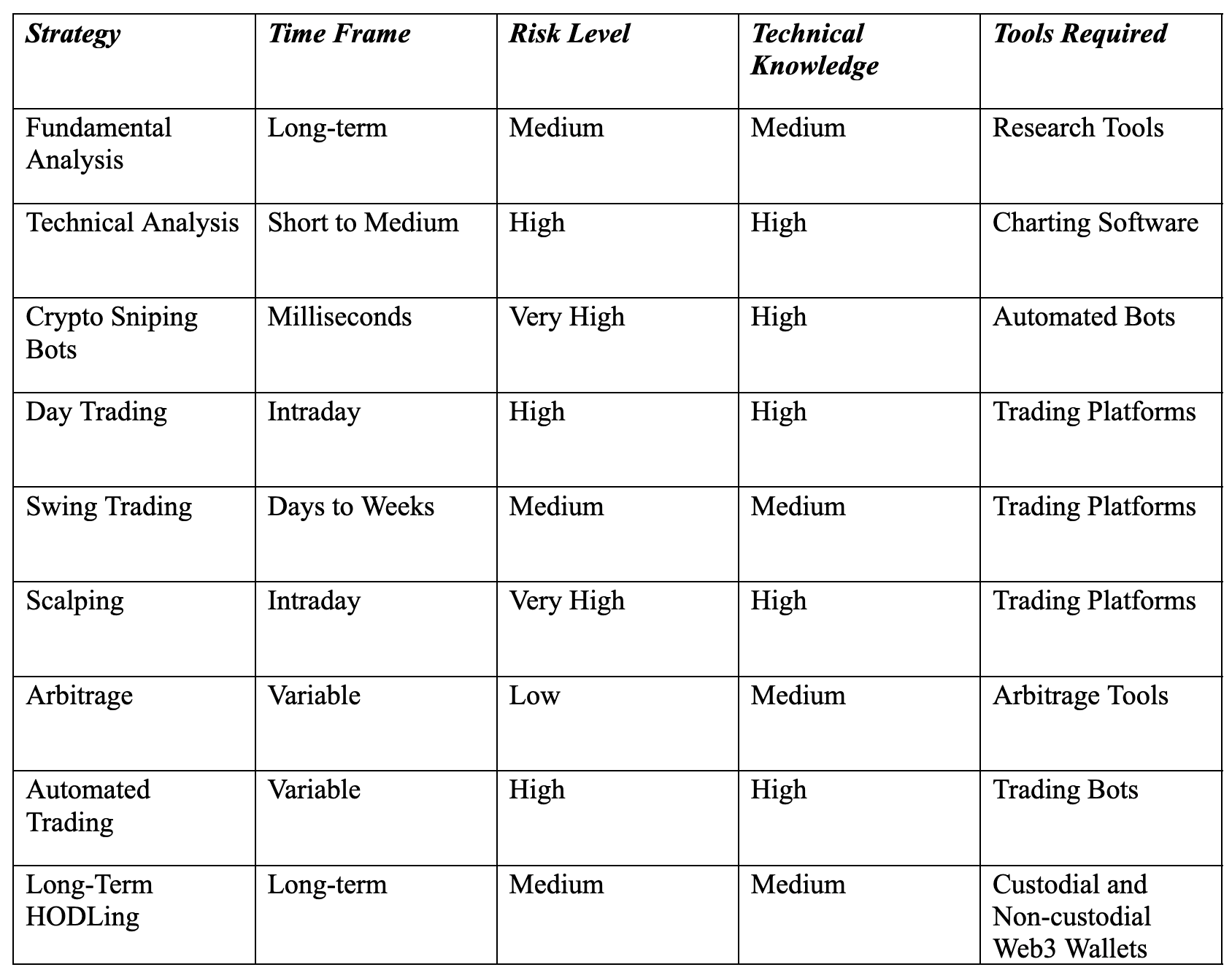

Now that you understand the different cryptocurrency market trading strategies, let’s explore how they stack against each other in terms of time frame, risk level, technical knowledge needed, and the tools required to implement each.

Choosing the right cryptocurrency trading strategy can be very daunting, especially if you’re a beginner in the middle of a crypto bull run, where every decision directly affects how successful you can be. So, what are the key factors that you should consider? They include:

Crypto-trading is not a one-size-fits-all for various reasons, including the fact that different investors have varying kinds of drive. In other words, everyone gets into digital asset trading with a different goal that suits their immediate, short-term, or long-term investment needs. In your case, if the goal is to generate a steady income, consider an investment technique with a relatively longer time frame, such as swing trading.

Conversely, day trading sounds ideal if you’re seeking immediate returns or want to maximize intraday profits.

You can have ambitious goals backed by a well-thought strategy to help you achieve them. However, the preparation would be useless if you’ve not set aside capital to seize opportunities when they present themselves. That said, designate the amount of money you can afford to risk without interfering with your other goals.

The amount of capital you deploy to back a strategy affects the type of cryptocurrencies you can trade, the tools you can leverage, and whether you can diversify your portfolio. Nonetheless, having a relatively small capital shouldn’t scare you. Start small and grow big, and you might eventually qualify for on-chain loans to fortify your war chest for advanced and high-stakes crypto trading. An important thing to note here is that you’ll need some crypto assets as collateral, depending on the loan issuer.

The crypto market can be lucrative but also highly volatile. In most cases, investors with “skin in the game” tend to experience the lucrative side of it, thanks to their high-risk appetite. That said, assess your risk tolerance to decide what works for you. If market volatility doesn’t scare you, you can consider strategies that rely on sudden price movements to generate profits, such as day trading. If you’re risk-averse, watch for techniques with fewer risks, such as long-term HODLing or arbitrage.

How much do you understand the game? This is a must-ask question when evaluating your trading experience. If you’re new to digital assets, you might want to consider user-friendly crypto trading strategies for beginners, such as long-term HODLing and swing trading. Once you master the basics, you can proceed to more advanced techniques.

The beauty of crypto innovation is that you no longer need to formulate technical strategies independently. Find platforms that support “copy trading,” allowing you to follow professional investors and replicate their trades on the go.

Although often overlooked, the prevailing regulatory landscape can influence what you can trade and the venue for deploying your strategy. Watch out for changing laws and regulations about digital assets and ensure your plan stays within their confines. For instance, some jurisdictions may demand that you trade on licensed crypto exchanges only, report your earnings, and remit taxes accordingly. Some cryptocurrencies may also be banned in certain regions, depending on the project’s adherence to regulatory guidelines.

Cryptocurrencies are no longer a fad—the industry has grown tremendously in the last decade to rival even the most established global markets, such as stocks and bonds. Leverage this guide to explore various trading strategies for digital assets and choose what best serves your investment goals, risk tolerance, available capital, and regulatory concerns. Most importantly, do in-depth research on your own to discover new ways of beating the market’s volatility, such as the Noti sniping service, to remain on the profit-taking side of the board in the ongoing crypto bull run.

Cryptocurrency trading strategies for beginners provide a user-friendly experience to allow you to maximize returns even from the comfort of your smartphone. They include fundamental analysis, arbitrage, swing trading, and long-term HODLing.

Using multiple crypto trading strategies simultaneously is highly encouraged. This allows you to diversify your approach, spread risks to different markets, and enhance your chances for profit, as each strategy may thrive under specific scenarios where others might stall. Additionally, employing multiple techniques helps traders balance short-term gains and long-term investment goals.

You can combine sniper bots with trading strategies that require precise execution and swift entry or exit to capitalize on sudden price movements. For instance, a sniper bot integrated with a swing trading approach will help you execute buy and sell orders near-instantly when predefined technical indicators align with the prevailing market conditions.

Choosing the right trading strategy for cryptocurrencies entails considering several factors, including your investment goals, capital availability, prevailing market conditions, individual risk tolerance, and government policy. While you want to maximize returns, you also want to stay on the right side of the law.

Share this article

Learn how to use DeFi sniper bots safely to protect your investments. Discover best practices to avoid hacks, scams, and frauds while navigating the DeFi ecosystem.

Crypto Market Sentiment: How it affects token sniping strategies in bull and bear markets? Learn how crypto sentiment tools can help maximize sniping opportunities.

Discover how Noti’s Ethereum sniper bot helps you snipe ETH tokens, Ethereum meme coins, and more. Learn how to snipe tokens on ETH and stay ahead in the crypto market.

Explore the world of liquidity sniping in crypto trading. Learn what liquidity sniper bots are, how to use them effectively, and the strategies to master this essential trading technique.

Discover how Noti Sniping Platform transforms Web3 UX with its user-friendly approach. Explore the benefits of this intuitive crypto sniping tool and why it stands out in the world of complex crypto tools.

Learn how to identify and avoid meme coin scams and high-risk crypto coins. Discover essential tips for spotting fraudulent tokens and safeguarding your investments.

Get exclusive bonuses, free tips,

snipe tutorials, and project updates