Using a DeFi Sniper Bot Safely: Protect from Hacks, Scams and Frauds

Learn how to use DeFi sniper bots safely to protect your investments. Discover best practices to avoid hacks, scams, and frauds while navigating the DeFi ecosystem.

Scamming has become profitable for illicit actors in the meme coin niche, with data insights indicating over $60,000 in weekly turnover for traders rugging 98% of meme tokens on pump.fun. Unscrupulous developers have hijacked the ongoing memecoin frenzy with sophisticated tools and tactics, making it even harder for the most experienced crypto investors to avoid becoming victims of their large-scale fraud schemes.

And if you lose your money to meme coin scams, it is likely gone like that and you might never recover it. Unlike traditional investment products, digital assets can be exchanged quickly between anonymous users with limited government or centralized oversight. In other words, the best way to stay safe and prevent losses due to token scams is to avoid becoming the prey altogether.

So, how do you do it? Here is an in-depth guide on how to identify scam tokens in the meme coin landscape, including resources that can help gauge a project’s legitimacy. Keep reading to also learn how tools like NOTI can shield you from bad actors.

Meme coins are cryptocurrencies inspired by images, videos, GIFs, or other sensational and viral cultural phenomena making buzz online. Although risk unlimited tokens inspired by memes and games have been around since 2013, when Dogecoin (DOGE) rose to prominence, a notable rejuvenation of investor interest in these cryptos was seen in 2024. As Bitcoin stagnated around the $60,000 level, investors resorted to other crypto alternatives offering higher returns with minimal entry barriers.

For context, while Bitcoin rose 48% in the first half of 2024, several memecoins printed triple-digit gains. These included Dogwifhat (WIF), Pepe (PEPE), and Floki (FLOKI), which surged 1,300%, 800%, and 418%, respectively, CoinMarketCap data shows. The early holders of these tokens made life-changing money quickly, including this trader who turned $310 into $5 million by flipping WIF.

With tales of overnight millionaires, these tokens may inspire your fear of missing out (FOMO) but they’re also inherently risky, partly due to their high susceptibility to scams. Additionally, like other digital assets, the oversight landscape for memecoins is evolving rapidly, making them prime targets for stringent regulations in some jurisdictions.

As the crypto market sets out for a bull run, with meme coins in focus, malicious actors have flooded the market with token scams that promise traders stupendous returns but leave them penniless. Let’s explore the common tactics scammers leverage to prey on unsuspecting investors and the prevalent red flags to watch out for to avoid becoming a victim.

Common tactics employed by scammers to exploit the excitement and lack of regulation in the meme coin landscape include:

Perhaps the most charming tactic used to perpetrate meme coin scams is false promises, which often works on people speculating to get rich quickly. Typically, scammers promise investors high returns if they purchase a new token, enticing them with the prospect of making life-changing money within a short period. While these promises can ignite hope, they are often far-fetched and seek to manipulate traders into buying a scam shitcoin without proper due diligence.

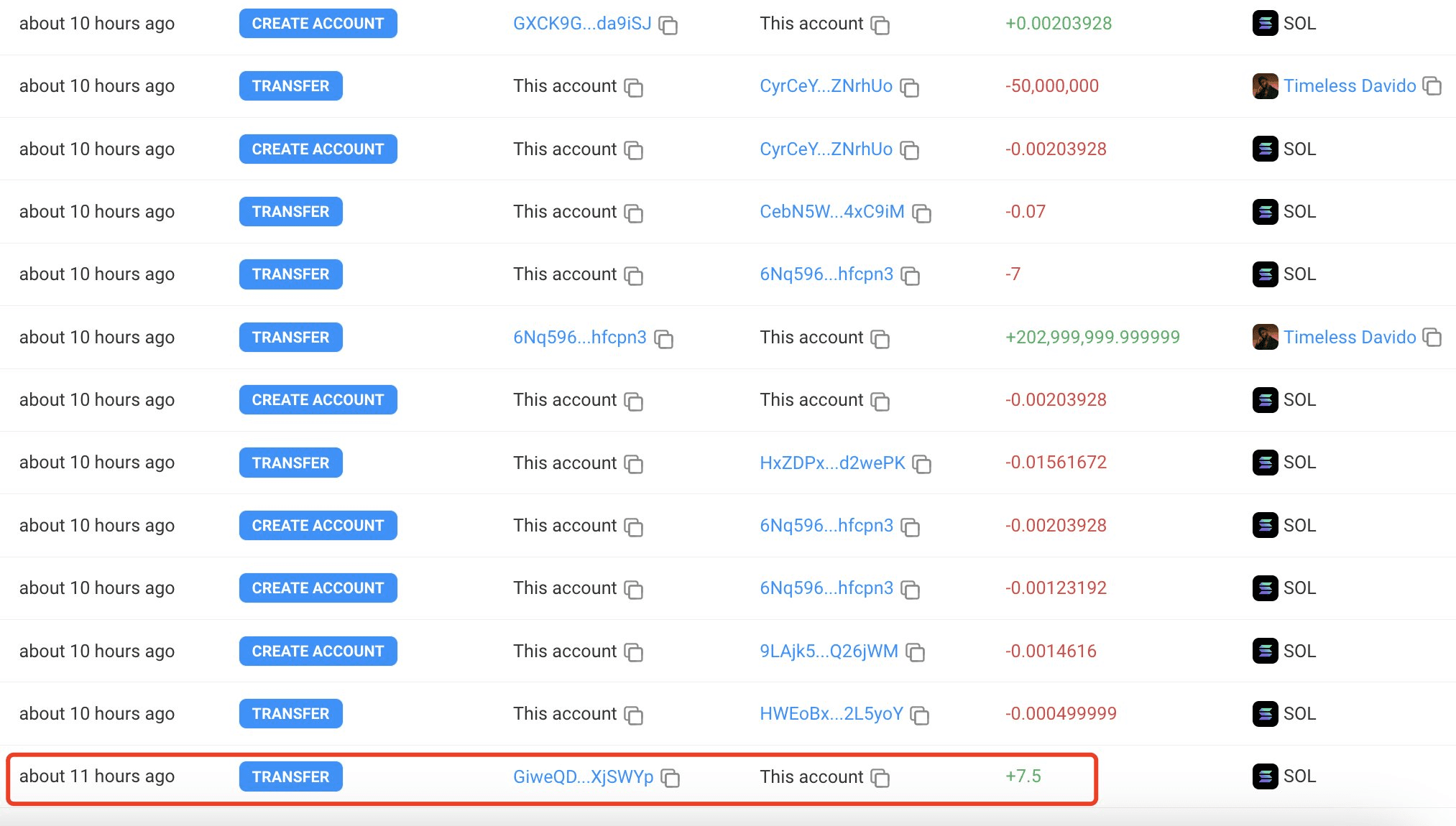

A good example of this tactic in play happened in May 2024. American-born Nigerian singer Davido created a memecoin dubbed DAVIDO and promoted it aggressively to his over 15 million followers on X (formerly Twitter). Davido promised investors that he would “HODL” alongside them until the meme coin unlocked a market cap of $30 million, leading some to believe in the token’s potential for a meteoric rise.

However, the singer broke his promise even before the day ended, dumping 121.88 million DAVIDO for 2,791 SOL 11 hours after creating the token. While this made him about $474,400, it left investors with a dubious token that plunged over 90% shortly after.

In addition to giving fake promises, meme coin scammers also use fake endorsements to lend credibility to the dubious token they promote and make it appear legitimate to potential early-stage investors. This may include featuring the token’s press release or presale information on social media pages or websites affiliated with reputable individuals and organizations in the crypto industry. Although such endorsements may inspire confidence, most of them are forged and often seek to deceive unsuspecting investors.

Earlier in 2024, an investor told Wired that he lost $750 in the presale of a token named Rebel Satoshi after falling for fake endorsements. In addition to having a press release that appeared to be featured on Yahoo Finance, the token’s team falsely claimed to have entered a “ground-breaking partnership” with crypto exchange BingX. These misrepresentations were planted as part of an elaborate hoax to lead the investor into believing in the token’s “legitimacy.”

Exaggerated claims make another common tactic malicious actors use to scam investors seeking meme coins with real-world utility. Scammers may hype a token’s potential utility, claiming that it has novel features and use cases that put it ahead of other cryptos. These claims may catalyze the hype around the scam, escalating demand and enticing more users to invest in the token. Besides inflating the token’s value, increased activity around the scam drives up the profitability chances of the bad actor.

In August 2024, a malicious actor hacked McDonald’s Instagram page to promote a fake memecoin dubbed $GRIMACE. While seasoned investors could tell it was a scam from the beginning, newbies couldn’t resist the exaggerated claim that holding $GRIMACE would win them a free breakfast. Although this was a pretty basic utility, some investors fell for the trap, with one losing $150,000 when the token’s developer rug-pulled $700,000.

Now that you understand common tactics bad actors use to get to you when casting about investment opportunities in meme coins, let’s look into the telltale signs of a potential scam. Here are the top red flags to watch out for if you want to avoid a scam shitcoin:

While some profitability chances are reasonable, be wary of memecoin projects that promise you quick and guaranteed results, especially if you invest a specific amount of money. As mentioned earlier, malicious actors often exploit the allure of quick gains offered by most meme coins to prey on unsuspecting investors, ultimately disappearing with their money.

Malicious actors often don’t have time or the expertise to write detailed whitepapers that inspire transparency and inform users of the meme coin’s goals, technology integrations, and ambitions. With this in mind, treat any project whose whitepaper is vague or lacks essential information as a potential scam seeking to swindle you of your hard-earned money.

It is encouraged to exercise great caution when interacting with a meme coin project whose team is anonymous or can’t be verified with a proven track record because this increases the risk of being defrauded. Typically, a trusted project should be willing to publicize the names of its developers and advisors to win the industry’s trust.

Meme tokens that lack liquidity lockers are susceptible to prevalent fraudulent activities like rug pulls, where the coin’s primary liquidity provider may redeem all its LP tokens, leaving other investors unable to sell. Projects that fail to lock their liquidity exude a lack of commitment to responsibility and transparency and cannot be trusted for short—or long-term investments.

Another red flag to watch out for when scouting for meme coins is the number of exchange listings they are tied to. Reputable projects with legitimate backing often strive to have their tokens listed on major centralized and decentralized exchanges (DEXs) to access deep liquidity and an extensive user base. On the other hand, scam projects list their tokens on fewer and less-known exchanges to avoid public scrutiny. Be wary of such meme coins.

Whether you’re buying a meme coin for the first time or you’re a seasoned trader with a blissful track record of gains, it’s always imperative to do extensive research before risking your precious money. Look at memecoin trading like any other investment. You want to obtain as many details as possible, ensure the person on the other end of the deal is reputable, and weigh alternative options to get the best your money can offer.

That said, here are two ways to spot high-risk cryptos:

One of the most reliable ways of gauging a coin’s credibility is by evaluating its whitepaper and researching the development team behind it. The document should outline the token’s utility and how the underlying project intends to interact with the broader blockchain ecosystem through technology integrations and partnerships. It should also reveal the project’s roadmaps, tokenomics, and goals while being free of spelling or grammatical errors.

After evaluating the token’s white paper and development team, review its market performance and trading volume to determine its liquidity depth and general market interest. Meme coin scams always carry high-risk tokens with a low trading volume and erratic price action, often buoyed by instability and manipulation instances.

On top of pulling the market metrics, leverage token scam checker tools to verify the credibility of the memecoin you intend to buy. Advanced tools like the NOTI Sniping platform can help identify potential red flags for rug pulls, such as restricted selling capabilities and high sale tax, reducing your risk of falling victim to fraudulent meme tokens. Some tools can also help identify other prevalent signs of a potential crypto coin scam, such as plagiarized whitepapers, fake team members, unlocked liquidity, and suspicious token distribution.

According to Blockaid, the number of meme coin presales surged fivefold between February and March 2024. A third of the 369 presales in March alone were flagged as scams, highlighting how malicious actors have infiltrated this niche. With hundreds of token launches each month, it can be pretty daunting to distinguish between legitimate memecoins and fraudulent ones. This is where a token scam checker tool comes in handy.

A scam token checker is a tool or platform that helps crypto investors evaluate the reputation and legitimacy of meme coins before adding them to their portfolio. With these tools, traders can get insights into various aspects of a meme token to determine its investment suitability, such as trading volume, market cap, utility, and overall credibility score. An advanced tool can also analyze the token’s whitepaper, community engagement, social media presence, and team member’s reputation.

However, while most tools for checking a shitcoin scam are user-friendly, you’ll get the most out of them if you leverage them effectively. Here are some pro tips:

Set up custom alerts to receive updates on the latest fraudulent meme tokens or tactics malicious actors employ.

Leverage tools that offer additional functionalities for extra guidance in navigating the risky memecoin landscape. This can be community forums or interactive bots for reporting crypto token scams.

Take advantage of the tool to double-check the legitimacy and reputation of meme tokens in your portfolio. This might help you avoid a potential crypto coin scam that has already trapped you before it’s too late.

Trust your instincts even when using an advanced tool to conduct a token scam check. If you feel something is wrong, it might be better to err on the side of caution than double down on something that might be risky.

Trading meme coins can be thrilling and risky. For the uninitiated, there are various pros and cons of putting your money on hot meme tokens, including:

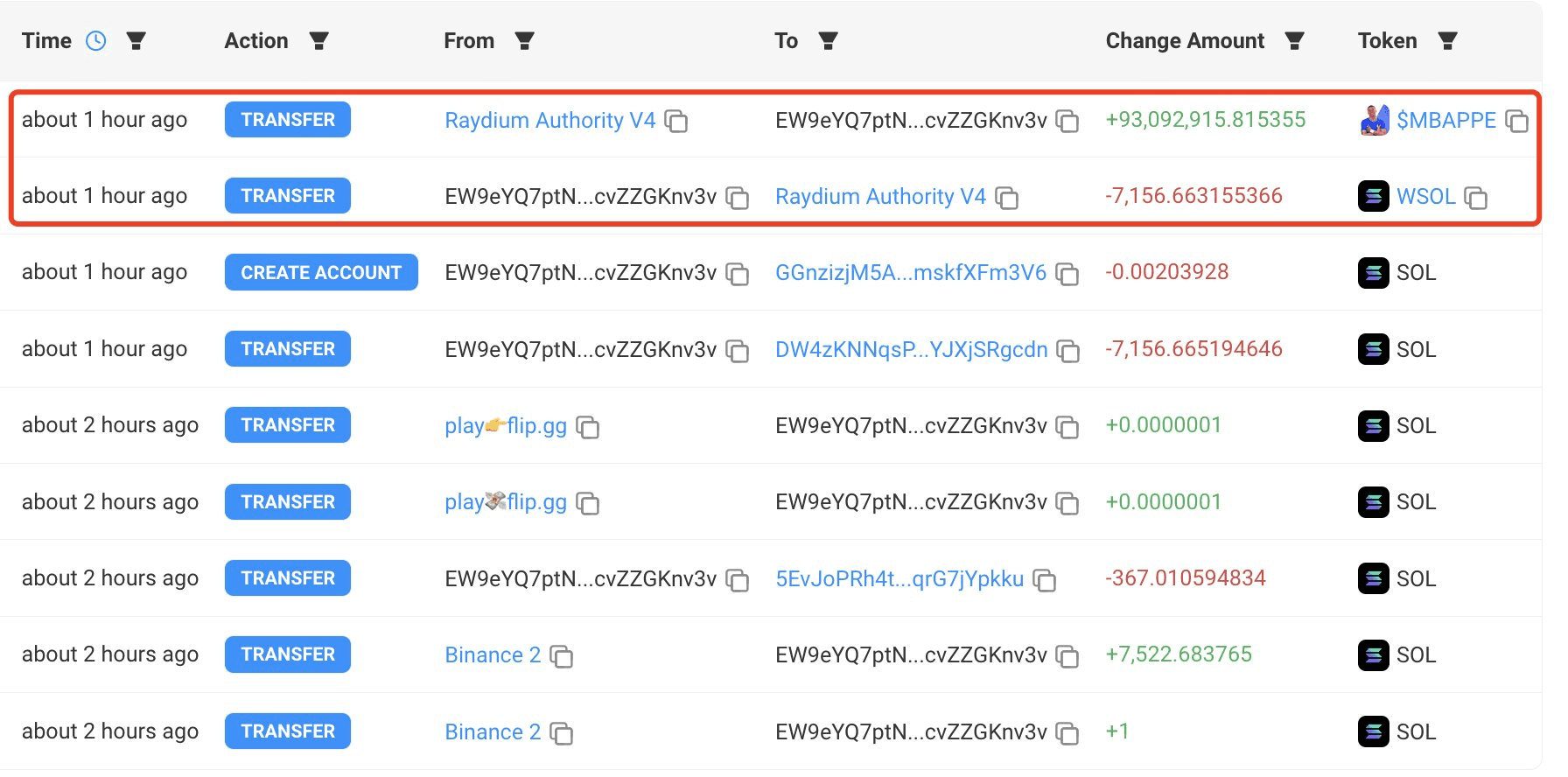

The surging number of scam cases in the memecoin landscape calls for investors to exercise great caution and vigilance to avoid joining the long list of users who’ve lost huge amounts, including this trader who got scammed over $1 million after investing in a fake Mbappe token.

Being cautious and vigilant includes leveraging:

Start by conducting thorough research and due diligence to extract in-depth information about a project. This can be a token’s supply, distribution mechanism, use cases, technology, and roadmap to determine whether the coin matches your short or long-term investment goals. Most importantly, you would want to evaluate the project’s team, partnerships, and community backing on social media channels to gauge whether its token has a high potential.

Another proven way of beating scammers at their game is avoiding dubious and unverified meme coins. This can include tokens that rose to prominence overnight, but their creators are reluctant to come forward and take responsibility or at least make themselves known to the public. Beneath the internet hype, creators of such tokens are often associated with fraud and manipulation.

Investors can leverage various resources to verify a token’s legitimacy by getting insights into various aspects, such as its trading volume, market capitalization, price history, and creators. This includes token scam checker tools like Token Sniffer, BSC Check, Dextools, UNCX, and block explorers, such as Ethereum, Binance Chain, and Polygon.

In addition to using token scam check software, you can leverage various reliable resources to verify a token’s information. This includes whitepapers, project websites, social media platforms, and crypto data aggregators, such as CoinMarketCap and CoinGecko.

Recommended tools that can help you detect and avoid meme coin scams include:

Meme coins can present a life-changing opportunity to amass a stupendous fortune quickly. However, this possibility carries several risks, including heightened market volatility, scams, and fraud. While price volatility is inherent, you can protect yourself from meme coin scams and fraud by conducting thorough research to gauge the credibility of various tokens. You can also use an advanced scam checker tool to verify the token’s contract address, liquidity, market cap, and top holders. Combining in-depth research with these tools increases profitability chances while minimizing risks.

Share this article

Learn how to use DeFi sniper bots safely to protect your investments. Discover best practices to avoid hacks, scams, and frauds while navigating the DeFi ecosystem.

Crypto Market Sentiment: How it affects token sniping strategies in bull and bear markets? Learn how crypto sentiment tools can help maximize sniping opportunities.

Discover how Noti’s Ethereum sniper bot helps you snipe ETH tokens, Ethereum meme coins, and more. Learn how to snipe tokens on ETH and stay ahead in the crypto market.

Explore the world of liquidity sniping in crypto trading. Learn what liquidity sniper bots are, how to use them effectively, and the strategies to master this essential trading technique.

Discover how Noti Sniping Platform transforms Web3 UX with its user-friendly approach. Explore the benefits of this intuitive crypto sniping tool and why it stands out in the world of complex crypto tools.

Don't miss out on the next big political memecoin! Get expert tips on investing and profiting in this wild market.

Get exclusive bonuses, free tips,

snipe tutorials, and project updates