Using a DeFi Sniper Bot Safely: Protect from Hacks, Scams and Frauds

Learn how to use DeFi sniper bots safely to protect your investments. Discover best practices to avoid hacks, scams, and frauds while navigating the DeFi ecosystem.

With the cryptocurrency market, as with any financial market, there are a number of strategies to choose from. For those focused more on the longer term and wanting to take a more passive approach to digital asset trading, a Warren Buffet-style buy-and-hold strategy is a good fit. But for people who want to take a more active role in their wealth accumulation, trading offers much more control and flexibility, with many ways to trade crypto to fit any trading style. One of the most powerful crypto trading tactics to emerge in the last few years is sniping. How is it different from regular crypto trading?

Trading crypto is in many ways similar to trading stocks, bonds, gold, and other assets, except that often one crypto is traded directly for another rather than for the dollar. Sniping, especially token swiping at launch, is an automated trading strategy to get a crypto token before most others can when the price is expected to go up, and then to sell it before others can before the price is expected to go down. It’s all about speed and precision.

It’s important to understand the difference between the two: sniping is more focused, more automated, and more high-pressure — since the speed of execution down to milliseconds can make a huge difference in the trade’s profitability.

Crypto trading is purchasing one cryptocurrency with another or taking a financial position in its price direction. It can employ many trading strategies.

On some centralized exchanges like Coinbase, crypto can be bought with fiat currency such as the United States dollar. Most crypto trading is when one crypto is sold for another. In fact, centralized exchanges work much the same as online stock trading platforms such as E*Trade, Charles Schwab, etc.

There are also decentralized exchanges and Automatic Market Makers (AMMs) like Uniswap, which don’t have centralized liquidity of cryptocurrencies but rather look at all the liquidity in the market and try to find the best source of the desired asset at the best price.

There are also platforms focused specifically on more advanced trading, such as derivatives and margin trading, where one can essentially borrow funds to speculate on a much higher amount of crypto than he has at stake. The cost of this is the funding rate interest charge and the risk of liquidation in case the price of the speculated asset goes too far in the opposite direction of where the trader hoped it would go. Such platforms include Polynomial, Hyperliquid, and dYdX.

Most crypto trading takes place on one of the above types of exchanges, with the more active traders trying our various advanced techniques higher in both risk and reward potential.

Different trading strategies are not just based on risk appetite, there are many approaches based on trading style and goals. So a full definition of what is crypto trading would include these different variations of it.

Spot trading is your most basic trading: buying one crypto for another or for fiat (e.g. USD). This is done when wanting to acquire an asset (perhaps for portfolio diversification) and wait for its price to grow or to use it somehow (e.g. providing liquidity in DeFi or getting into a token-gated DAO). When spot trading buys at the market price, one can overpay. But at least it executes immediately, so the purchaser can immediately accrue value from any price appreciation. Using different order types, like limit and stop orders, gives a trader more flexibility and control.

As mentioned above, margin trading allows one to purchase a much larger amount of an asset than he has the capital to purchase in spot trading by taking out a virtual loan “the margin” on which an interest (“funding rate”) is charged and which can liquidate the trader’s entire position if it falls below specific margin requirements (i.e. if the price action really doesn’t go the trader’s way). The higher the margin, the higher the interest rate and chance of liquidation. With margin trading, one can profit substantially from even small price movements — but can also lose it all. So it’s important to keep an eye on technical indicators while backtesting strategies and keeping enough of a margin to avoid liquidation.

Unlike with stocks, most crypto futures trading is perpetual, meaning that there is no specific redemption date by which one must purchase the asset on the price of which he’s betting. As such, futures trading is often bunched in with margin trading, with both having similar strategies and risks. Technically speaking, futures trading is purchasing the speculation of an asset’s price movement rather than the actual asset, meaning that no asset actually changes hands. The exchange simply opens a speculative position and pays out any profits (or collects losses) when the trader closes the position.

Day trading can also be called “glued-to-the-screen” trading because day traders tend to trade multiple times a day (some even trading hundreds of times per day) in order to take advantage of every little price movement that happens in the daily volatility of a market. With good discipline in using stop-loss orders to never lose more than a set percentage of the invested capital, day trading can accumulate wealth one micro-trade at a time. But it is very time- and energy-consuming. Day trading also requires a good understanding of technical analysis.

Crypto is infamous for its high market volatility. Swing trading takes advantage of that volatility to trade on the ups and downs. This can be for very small intervals of minutes (or even seconds for high-frequency trading) or large intervals (even months or years). The hard part is to always guess the right time for the swing to be going the trader’s way and not the other way around. That’s why both fundamental analysis and technical analysis can play a role. When the price range suddenly shifts dramatically up or down, swing traders risk losing big or even being liquidated without proper stop-loss orders in place.

Get exclusive bonuses, free tips, snipe tutorials, and project’s updates

What are the pros and cons of crypto trading for those who want to engage in it?

Understanding these pros and cons can help one choose the appropriate crypto trading apps and strategies.

Before we can talk in-depth about crypto sniping strategies, it’s important to understand exactly what crypto trading bots are and how they work.

In simple terms, crypto sniping is automated crypto trading using pre-programmed automated trading bots to buy or sell an asset before others can, at an advantageous price. Sniping trades are performed rapidly — in milliseconds, which is why it’s done by specialized bots using advanced algorithms to know precisely when and how to execute a transaction intended by the user. As such, it is a type of algorithmic trading. Here, we focus mostly on sniping token launches.

Sniping bots are programmed to look for the precise moment a token is launched by its team. The logic is simple: new tokens attract attention, especially ones with hype. Since no trader owns any of the launching tokens, there will be a lot of buy orders, driving the price up. Of course, in reality, there will also be sell orders fueled by speculators and those who want to sell their tokens acquired at pre-sales. But the hope is that the price will pump upward. The role of the sniper bot is to get the new token before anyone else — i.e. before the pump starts.

Crypto sniper bots are programmed to see the token launch in its initial block and to place their users’ orders into the same block in order to execute trades before the public even sees the launch. Naturally, multiple bots and users will compete for popular launches. This launched essentially what is crypto sniping competition among bots.

Since orders go into a public mempool (waiting area), bots can try to outbid each other by offering a higher gas fee to the block producers who are incentivized to accept transactions with higher gas fees first since this is their direct income.

Thus, if a crypto sniper bot sees a transaction request and can get ahead of it (known as front-running), this can force that other transaction to occur at a higher price (because of the buy-side price pressure). After subsequent transactions are also pushed to buy at higher prices, the crypto sniper who sniped first can now sell at a market price much higher than the price the bot initially bought the token at. This is, of course, oversimplified as an illustration of the general principle. In essence, the best crypto sniper bots wins.

As such, sniping with a crypto trading bot is very powerful for those who understand how to snipe crypto. But a crypto sniper too has its pros and cons.

In short, crypto sniping bots can be very lucrative but difficult for non-technical people. At least until the user-friendly Noti sniping platform is released.

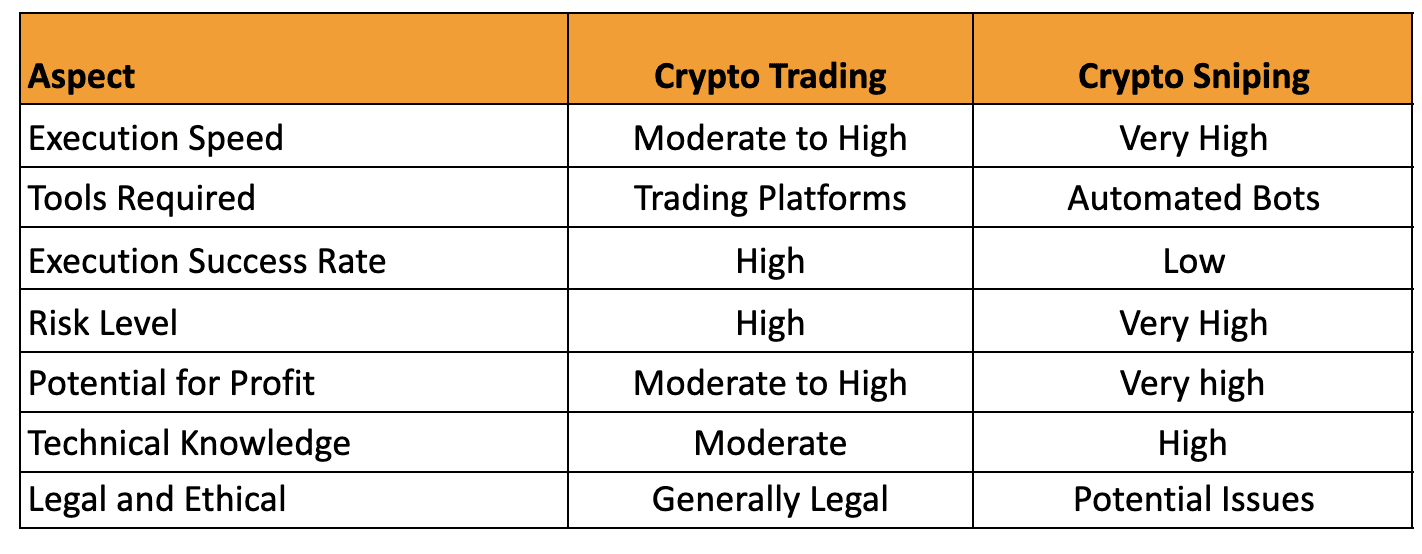

So how do trading and sniping measure up against each other? What is a sniper bot crypto strategy in relation to a non-sniper one?

The table below is a handy quick illustration of key differences between trading and sniping.

With all the pros and cons compared, how is one to choose the right strategy?

There are hundreds of crypto trading platforms. Here are just a few of the more trusted ones.

Crypto has been under legal and ethical scrutiny as soon as it proved itself a real market sector. This scrutiny extends to both trading and sniping crypto.

Various government regulators, like the SEC in the United States, try to place restrictions, taxation, and even outright bans on crypto trading, even going as far as accusing exchanges of money laundering.

Some exchanges have been shut down, fined, or are still being prosecuted by authorities. Still, crypto trading itself is just like trading stocks, bonds, Forex, and other assets. There have not been any known serious cases of the authorities going after individual traders.

Crypto sniping is so new that there hasn’t been much attention from the authorities. There is nothing illegal about using bots for trading — high-frequency traders have done that since the 1980s. There are ethical questions about using bots to get in before others can because it feels like an unfair advantage or even insider trading. But the entire point of sniper bots is that they give early access to outsiders. So the ethical and legal arguments against sniping bots appear unfounded.

It is ultimately up to the individual trader on which approaches to use. Obviously, both trading and sniping can be used in various combinations. As of today, it appears that sniping can provide the highest returns in today’s volatile crypto market situation where high profit opportunities can keep appearing for years or can disappear forever at any moment. Technical hurdles and costs prevent many people from taking advantage of current sniping bots. But the upcoming release of the next generation of sniping bots like the Noti sniping service (which has simple UX, executes orders before other bots, and has a pricing structure that makes it essentially free to use) have the potential to make sniping bots the tool of choice for crypto traders of any skill and technical level.

Share this article

Learn how to use DeFi sniper bots safely to protect your investments. Discover best practices to avoid hacks, scams, and frauds while navigating the DeFi ecosystem.

Crypto Market Sentiment: How it affects token sniping strategies in bull and bear markets? Learn how crypto sentiment tools can help maximize sniping opportunities.

Discover how Noti’s Ethereum sniper bot helps you snipe ETH tokens, Ethereum meme coins, and more. Learn how to snipe tokens on ETH and stay ahead in the crypto market.

Explore the world of liquidity sniping in crypto trading. Learn what liquidity sniper bots are, how to use them effectively, and the strategies to master this essential trading technique.

Discover how Noti Sniping Platform transforms Web3 UX with its user-friendly approach. Explore the benefits of this intuitive crypto sniping tool and why it stands out in the world of complex crypto tools.

Learn how to identify and avoid meme coin scams and high-risk crypto coins. Discover essential tips for spotting fraudulent tokens and safeguarding your investments.

Get exclusive bonuses, free tips,

snipe tutorials, and project updates